A debate is raging among mid-market business leaders as to what COVID-19 means for their exports and international supply chains. Shutdowns have caused major disruptions internationally, but also in local markets. So, should companies’ sales and supply focus be more domestic or more international? Are overseas markets an unnecessary risk or a smart hedge?

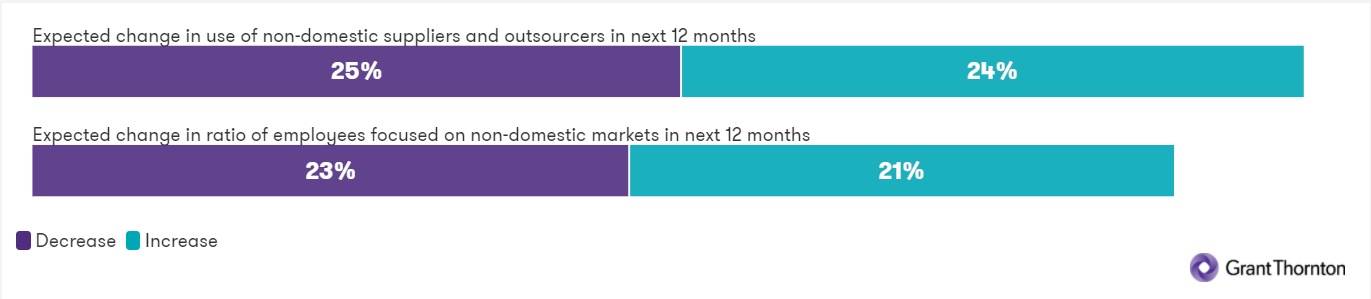

The conflicting opinions are revealed in our research into resilience in the mid-market, conducted in May and June. For the first time, we asked companies about their prioritisation of international markets and supply chains in the next 12 months. We found that most companies are looking to change how they prioritise these two related areas, but there is a startling level of disagreement as to whether to increase or decrease their international focus. At a global level and by a slim majority the intention is to decrease prioritisation of international sales and supply chains, although there’s plenty of variation across geographies and sectors.

The results chime with what we’ve seen in our longer-running tracking of export expectations among mid-market companies, which showed export expectations for H1 2020 falling but not by as much as other growth measures, with a slim majority of 27% expecting to decrease exports in the coming year, compared with 25% expecting an increase.

Globalisation is not dead

The continued prioritisation of international markets – and the fact that around three-quarters of mid-market businesses sell goods or services abroad – is a timely reminder that “Globalisation is not dead. It may just look a little different. International trade is such an important part of the mid-market universe and may provide opportunities where domestic markets are struggling,” notes Francesca Lagerberg, Global leader – network capabilities at Grant Thornton International Ltd.

Factors such as business models, leadership and market opportunities will inevitably influence the importance that companies attach to international sales and supply chains. Usefully, our analysis finds the rule of thumb is that international supply chains are prioritised as much or as little as international sales: those prioritising international sales also prioritise international supply chains, and vice versa.

Geographically, the more developed regions of Asia Pacific, Western Europe and to some degree North America are currently shifting their sales and supply focus back towards domestic markets, while emerging regions remain more internationally focused. This could have significant economic impacts on the global economy depending on the scale and speed of these changes. The relatively early hit by COVID-19 to many developed countries during the IBR research months of May and June explains some of this pullback, while continued optimism and importance of trade may explain the resilient global focus of emerging markets.

At sector level, there are nuances aplenty. Sectors which are at the very heart of the national interest, like healthcare, education and transport are certainly seeing more domestic focus, as are consumer sectors like travel, tourism and leisure and consumer products. In many countries, restrictions and concerns about international travel have seen domestic tourism surge. And COVID-19 is also having some indirect impacts on demand.

Trefor Griffith, head of food and beverage (F&B) at Grant Thornton UK LLP, observes that “During lockdown, consumers have been recognising that there are things that they can do to help the environment – like buying locally and reducing the amount of travel – and this has boosted domestic demand.” He notes that sustainability isn’t a new trend in F&B, but its progress has been accelerated by COVID-19.

Trefor Griffith, head of food and beverage (F&B) at Grant Thornton UK LLP, observes that “During lockdown, consumers have been recognising that there are things that they can do to help the environment – like buying locally and reducing the amount of travel – and this has boosted domestic demand.” He notes that sustainability isn’t a new trend in F&B, but its progress has been accelerated by COVID-19.

Internationalisation is still firmly on the agenda for many sectors. Technology, media and telecoms has always been very global in its sales and supply chain focus, and it tops the list of sectors looking to further prioritise international markets in the next year. Among the other sectors looking to grow their international focus are financial services, and construction and real estate.

Trefor reminds business leaders that COVID-19 hasn’t fundamentally changed the considerations for businesses when deciding to internationalise products. “You still need to work out who would want to consume the product and whether you can get it there at a price they will pay. You still need to do the diligence to make sure it will be a success, then plan, plan and plan and make sure you have the right support to execute your strategy.”

COVID-19 amplifies pre-existing supply chain challenges

When it comes to thinking about supply chains, it’s important to recognise that COVID-19 is just the latest in a long line of shocks to international supply chains. The escalation of the US-China trade war already had many businesses thinking about supply chain disruption and how best to deal with this. Last year, we noted that having multiple supply chains was as critical as ever and identified that some companies were adopting a ‘China plus two or three’ strategy for greater resilience, establishing secondary suppliers in multiple countries.

“This amplifies the supply chain issues that we have already seen and I think it is accelerating decision-making around supply chains. People are now thinking ‘we have got to bring it home – or closer to home’,” says Rodger. A closer to home shift could inevitably favour the lower costs countries in Europe, Asia Pacific and the Americas. But he cautions that a significant recalibration of supply chains will require real investment at a time where finance is much less accessible, and that the speed and scale of changes may depend on government incentives.

Business leaders have certainly shown a desire to improve the resiliency of their supply chains, with more than one-third globally saying that this is something they will need to address after the Covid-19 crisis.

Scott Wilson, advisory director at Grant Thornton International Ltd, advises against any knee-jerk decision-making and stresses the importance of considering multiple factors when thinking about international supply chains, such as the political and economic stability of the markets, taxation, availability of suitable labour supply, the cost base, intellectual property protection, the regulatory environment and the security of access to raw materials.

Scott Wilson, advisory director at Grant Thornton International Ltd, advises against any knee-jerk decision-making and stresses the importance of considering multiple factors when thinking about international supply chains, such as the political and economic stability of the markets, taxation, availability of suitable labour supply, the cost base, intellectual property protection, the regulatory environment and the security of access to raw materials.

Robert suggests that a more fruitful supply chain move might be away from single or multiple providers towards strategic partnerships. “These partnerships would be much more flexible, and rather than locking you into one country, one supplier or a set allocation, would allow you to turn things on or off at different levels in the supply chain according to shifting situations and needs.”

While fundamental changes to supply chains will be a consideration for some, the question for many is whether to abandon a just-in-time approach to production and instead focus on building up raw materials and finished stock to counter any future disruptions – a ‘just-in-case’ approach. While some level of excess may be sensible for now, Francesca advises against a fundamental departure: “Just-in-time is not a thing of the past. The pandemic has made this more complicated, but the efficiency and margin advantage to a business of just-in-time have been so important for businesses. New business models may emerge from the pandemic but it will still be important to keep what works from the past.”

Scenario planning is the best way to ride out volatility

All our leaders stress the importance of scenario planning in helping businesses to work out the best way of dealing with the immediate challenges of COVID-19 on international sales and supply chains. “Those that have thought about the ‘what if’ questions will have worked out plan Bs to allow them to be agile and resilient. Businesses that want to manage their risk profile and be well positioned to take advantage of opportunities must engage in effective scenario planning,” says Scott.

For the medium to longer term, Scott notes that businesses will need to keep re-evaluating their international footprints. “As the impact of COVID-19 dissipates, factors like flexibility, reliability, cost and the market opportunity will continue to be important considerations for businesses seeking growth – with a purely domestically-focussed strategy being a limiting, and for some, unsustainable strategy.”

Contact a Grant Thornton adviser in your location to discuss COVID-19 and what it means for your international sales and supply chains.

Robert Hannah

Robert Hannah