-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

In this article we discuss how to identify cash-generating units (CGUs), and in our following articles we cover how to allocate assets to them and also then to allocate goodwill to them.

Identifying CGUs is a critical step in the impairment review and can have a significant impact on its results. That said, the identification of CGUs requires judgement. The identified CGUs may also change due to changes in an entity’s operations and the way it conducts them.

In this article

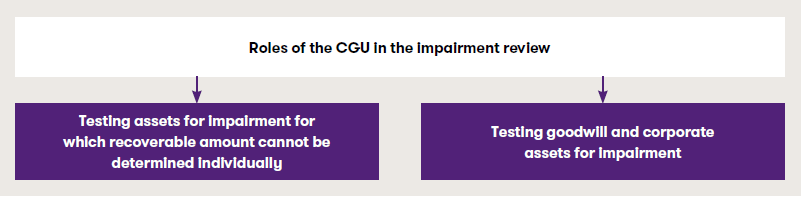

Roles of the cash-generating unit in the impairment review

A CGU serves two primary roles in the impairment review. It facilitates the testing of:

- assets for which the recoverable amount cannot be determined individually, and

- goodwill and corporate assets for impairment.

Goodwill and corporate assets by definition do not generate cash inflows on their own and therefore, must be allocated to a CGU or groups of CGUs for impairment testing purposes. The allocation of goodwill and corporate assets is discussed in our articles ‘Insights into IAS 36 – Allocating assets to cash-generating units’ and ‘Insights into IAS 36 – Allocating goodwill to cash-generating units’.

Identifying cash-generating units

The objective of identifying CGUs is to identify the smallest identifiable group of assets that generates largely independent cash inflows. CGUs are identified at the lowest level to minimise the possibility that impairments of one asset or group will be masked by a high-performing asset.

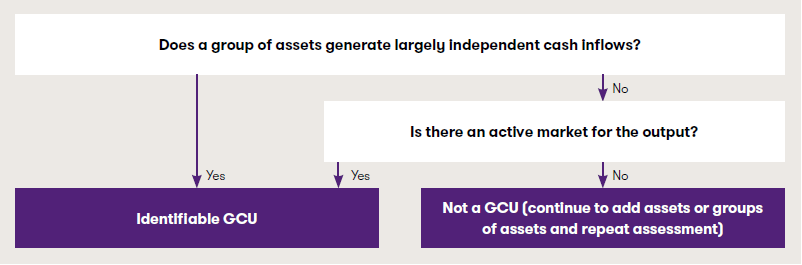

To identify a CGU, an entity asks two questions:

- Does a group of assets generate largely independent cash inflows?

- Is there an active market for the output?

Does a group of assets generate independent cash inflows?

Put simply, identifying CGUs involves dividing the entity into clearly identifiable components. Because the CGU definition is based on cash inflows, the division process should focus on an entity’s sources of revenue and how assets are utilised in generating those revenues. Management will need to consider various factors including how it monitors the entity’s operations (such as by product lines, businesses, individual locations, districts or regional areas) or how management makes decisions about continuing or disposing of the entity’s assets and operations.

Practical insight

Operational structure over legal structure

It may be the case that the design and management of an entity’s operations does not reflect the legal structure of the group. Depending on the circumstances, a CGU might correspond to a legal entity, a division, product line, geographic region, physical location (such as a hotel or retail store) or collection of assets.

The following examples illustrate the identification of the lowest aggregation of assets that generate largely independent cash

inflows in different circumstances.

Example 1 - Identifying the CGU: lowest level of largely independent cash inflows

A bus company provides services under contract with a municipality that requires minimum service on each of five separate routes. Assets devoted to each route and the cash flows from each route can be identified separately. One of the routes operates at a significant loss.

Because the entity does not have the option to curtail any of those bus routes, the lowest level of identifiable cash inflows that are largely independent of the cash inflows from other assets or groups of assets is the cash inflows generated by the five routes together. The CGU is the bus company as a whole.

Example 2 - Identifying the CGU: supermarket chain

Entity A owns and operates 10 supermarkets in a major city (City B), each store residing in a different suburb throughout City B. Each supermarket in City B purchases its inventory through Entity A’s purchasing centre. Pricing, marketing, advertising and human resources policies (except for the hiring of each supermarket’s local staff) are decided by Entity A. Entity A also operates 50 other supermarkets in other major cities across the country.

The supermarkets in City B probably have different customer bases as they reside in different suburbs. Accordingly, although operations are managed at a corporate level by Entity A, each supermarket generates cash inflows that are largely independent of those of other supermarkets. Therefore, it is likely each supermarket in City B is a separate CGU.

In making its judgement about whether each supermarket is a separate CGU, Entity A might also consider if:

- management reporting monitors revenues on a supermarket-by-supermarket basis in City B, and

- how management makes decisions about continuing or closing its supermarkets (eg on a store-by-store or on a region/city basis).

The IFRS Interpretations Committee (IFRIC) was asked to develop an Interpretation on whether a CGU could combine more than one individual store location. The submitter developed possible considerations including shared infrastructures, marketing and pricing policies, and human resources. The IFRIC noted IAS 36 requires identification of CGUs on the basis of independent cash inflows rather than independent net cash flows and so outflows such as shared infrastructure and marketing costs are not considered. In its March 2007 agenda decision, the IFRIC took the view developing guidance beyond that already given in IAS 36 on whether cash inflows are largely independent would be more in the nature of application guidance and therefore decided not to take this item onto its agenda.

Is there an active market for the output?

When management has identified a group of assets that generate an output, but those assets do not generate largely independent cash inflows, it needs to consider if there is an active market for the output.

For the purposes of applying IAS 36, even if part or all of the output produced by an asset (or a group of assets) is used by other units of the entity (ie products at an intermediate stage of a production process), this asset (or group of assets) represents a CGU if the entity could sell the output on an active market. This is because the asset (or group of assets) could generate cash inflows that would be largely independent of the cash inflows from other assets (or groups of assets).

Practical insight

Vertically integrated businesses and an active market for output

This is a common issue for vertically integrated businesses whereby some groups of assets do not generate independent cash inflows, only because each operation’s output is used internally, rather than being sold externally. IAS 36 addresses this issue by clarifying that even if part or all of the output produced by an asset (or a group of assets) is used by other units of the entity, this asset (or group of assets) forms a separate CGU if the entity could sell the output on an active market. An active market is defined in IFRS 13 ‘Fair Value Measurement’ as ‘a market in which transactions for the asset or liability take place with sufficient frequency and volume to provide pricing information on an ongoing basis’. This may be the case for certain commodities such as oil or gold.

Example 3 - Identifying the CGU: active market for the output

Entity X produces a single product (widgets) and owns production plants 1, 2 and 3. Each plant is located in a different region of the world. Plant 1 produces a component of the widgets that is assembled in either plant 2 or plant 3 and sold worldwide from either plant 2 or plant 3. Neither plant 2 nor plant 3 is operating at full capacity.

The utilisation levels depend on the allocation of order fulfillment between the two locations of order fulfillment between the two locations.

Scenario 1: There is an active market for plant 1’s component.

Scenario 2: There is no active market for plant 1’s component.

Scenario 1: It is likely plant 1 is a separate CGU because there is an active market for its output. As cash inflows for plants 2 and 3 depend on the allocation of production across the two locations, it is unlikely the future cash inflows for plants 2 and 3 can be determined individually so they would probably be combined into a single CGU.

In determining the VIU of plants 1, 2 and 3, Entity X will adjust its financial budgets/forecasts to reflect its best estimate of future prices that could be achieved in arm’s length transactions for plant 1’s output while also incorporating future cash outflows used to determine the VIU of other assets impacted by the internal transfer pricing.

Scenario 2: It is likely the three plants (1, 2 and 3) are a single CGU because:

- there is no active market for plant 1’s output and its cash inflows depend on sales of the final product by plants 2 and 3

- cash inflows for plants 2 and 3 depend on the allocation of production across the two locations. It is unlikely the future cash inflows for plants 2 and 3 can be determined individually.

Where the cash inflows generated by an asset or CGU are affected by internal transfer pricing, an entity uses management’s best estimate of future prices that could be achieved in an arm’s length transaction in estimating:

- the future cash inflows used to determine the asset’s or CGU’s value in use (VIU), and

- the future cash outflows used to determine the VIU of any other assets or CGUs that are affected by the internal transfer pricing.

When the group of assets does not generate cash inflows that are largely independent and there is no active market for its output (even if used internally), the group is not a CGU. Management then has to combine these assets with others that contribute to the same revenue stream until a CGU is identified.

Changes in identified cash-generating units

Unless a change is justified, CGUs are identified consistently from period to period for the same asset or types of assets. If a change in CGUs is justified (eg an asset belongs to a different CGU than in previous periods or previously recognised CGUs are combined or subdivided), and an impairment loss is recognised or reversed for the CGU, the entity should disclose additional information.

Practical insight

Triggers for a change in CGU structure

IAS 36 does not provide examples of events or circumstances that would justify a change in CGUs. Such a change would generally be appropriate only if there has been a change in the entity’s operations – ie different revenue-generating activities or different utilisation of assets in undertaking those activities. Typical triggers for a change might include:

- business combinations or divestments

- restructurings

- introduction or withdrawal of products or services, or

- entry to or exit from new markets or regions.

Practical insight

A change in CGU structure over time

The factors that justify a change in CGU structure sometimes develop over time rather than being driven by a specific event. For example, an entity might gradually change the way it allocates order intake across its production facilities or how it utilises assets to generate a revenue stream. In our view, the change in CGU structure is justified if an asset’s cash inflows become, or cease to be, independent even if this cannot be attributed to a specific event. One practical suggestion for determining the effective date of the change is to consider when management began reviewing or assessing the CGUs differently (eg when management reporting changed).