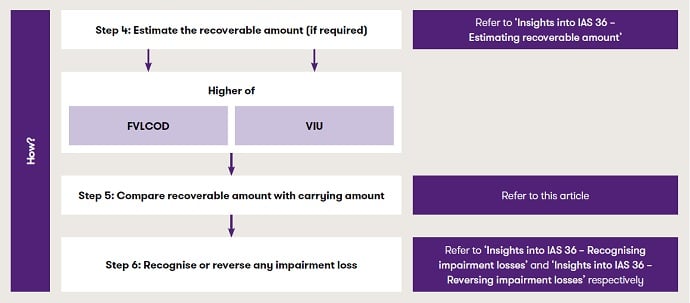

This article discusses when there are exceptions to the rule of comparing recoverable amount with carrying amount, which is step 5 in the impairment review process, as shown below. Download the full 'Comparing recoverable amount with carrying amount [ 170 kb ]' article for more information and examples.

IAS 36’s step by step impairment approach is explained and set out in full in our article ‘IAS 36 – Overview of the Standard’. However to give some context over how the next three articles fit into this approach, here is a reminder of steps 4 to 6 (the ‘How’ part of the process).

In this article

After calculating the asset’s recoverable amount (as discussed in Step 4), the next step is to compare this to the carrying amount. Where the carrying amount exceeds the recoverable amount, the entity will record an impairment loss (Step 6).

Although making this comparison may appear straightforward, practical issues arise in relation to:

- including the right assets (and, in limited circumstances, liabilities) to ensure a ‘like for like’ correspondence with the cash flows underpinning the recoverable amount

- the order of testing for purposes of comparing the carrying amount to the recoverable amount when allocated corporate assets or goodwill relate to more than one cash-generating unit (CGU).

Like-for-like comparison of recoverable amount and carrying amount of a CGU

When assets are grouped for recoverability assessments, it is important to include in the CGU all assets that generate or are used to generate the relevant cash inflows. If assets are omitted inappropriately, the CGU may appear to be fully recoverable when an impairment loss has in fact occurred. The overarching objective is that the CGU’s carrying amount is determined consistently with its recoverable amount.

The recoverable amount of a CGU (as discussed in Step 4, refer to our article ‘IAS 36 – Estimating the recoverable amount’) is determined excluding cash flows that relate to:

- assets whose cash flows are largely independent of the cash inflows from the asset under review (for example, financial assets such as receivables)

- liabilities that have already been recognised

Certain exceptions to this general rule apply and are discussed in more detail below.

Exceptions to the rule – including other assets and liabilities

Liabilities that are inseparable from the CGU

It may be necessary to consider some recognised liabilities to determine the recoverable amount of a CGU. This may be the case when the disposal of the CGU would require the buyer to assume the liability. As such, the fair value less cost of disposal (FVLCOD) of the CGU might be estimated using pricing information that takes account of the liability that buyers would assume. To perform a meaningful comparison between the carrying amount of the CGU and its recoverable amount, the liability is also deducted from the CGU’s carrying amount and the cash flows from settling the liability are included in the value in use (VIU) calculation. The example below illustrates this point.

Practical insight – Including liabilities that relate to the CGU

The key reason to include some liabilities in a CGU is the market-based transaction price on which fair value is based necessarily includes the transfer of any liabilities that are inseparable from the asset. If the impairment test is based solely on VIU (for example, because FVLCOD cannot be measured reliably) it may not be necessary to include inseparable liabilities and the related cash flows to achieve a meaningful and like-for-like comparison. In any case, including or excluding the liability (and related cash outflows) will often make little or no practical difference (for example, if the liability is short-term or if it is discounted using a similar rate to that used for estimating VIU).

Other assets/liabilities

Sometimes, for practical reasons, the recoverable amount of a CGU is determined after consideration of assets that are not part of the CGU (for example, receivables or other financial assets) or liabilities that have been recognised (for example, payables, pensions and other provisions). In such cases the carrying amount of the CGU is:

- increased by the carrying amount of those assets, and

- decreased by the carrying amount of those liabilities.

Practical insight – Other assets/liabilities

The carrying amount of a liability may not be the present value of its future cash outflows or may not be discounted using the same rate as for estimating VIU. One such example is a pension obligation which might be discounted using a high quality corporate bond rate. If an entity includes the pension contributions in its cash flows for VIU purposes, it will need to consider if some portion of those contributions relates to past services and is therefore a settlement of part of the pension liability. Achieving a like-for-like comparison is potentially a complex exercise. However, it is not possible to simply ignore the costs of providing pensions and other employee benefits when estimating VIU and a pragmatic approach (such as including future service costs rather than contributions, and excluding the liability) might need to be taken.

Practical insight – Rent-free periods

A situation frequently met in practice is the case of ‘rent-free’ periods not arising as a consequence of the COVID-19 pandemic, whereby a lessee recognises a liability and expense during the period of time in which no cash payment is due to the lessor as a result of straight-lining the lease payments over the lease term. A question arises as to whether the lessee should include this liability as part of the carrying amount of the CGU being tested for impairment if the estimates of future cash flows include 100% of the future lease payments (therefore including those that effectively settle the liability).

As discussed in our article ‘IAS 36 – Value in use: estimating future cash inflows and outflows’, in estimating VIU, an entity will incorporate the future cash inflows and outflows from continuing to use the group of assets and from its ultimate disposal; however, estimates of future cash flows would not include cash outflows for settling liabilities that have already been recognised unless the associated liability is included as part of the CGU being tested for impairment. In the case of a rent-free period, comparing like-for-like could be achieved either by:

- including all the future lease payments in the cash outflows when estimating VIU and deducting the rent-free period liability from the CGU’s the carrying amount

- excluding both the liability and the portion of the future lease payments that effectively settle it. In many cases including the straight-lined based lease expense (instead of the full lease payment) should prove a sufficiently accurate approximation.

Practical insight – Working capital balances

In our view, cash flows from the settlement or realisation of working capital balances (that exist at the measurement date) may be included or excluded in the cash flow projections in estimating VIU, so long as a consistent approach is taken when deriving the carrying amount of the CGU. The net effect should be insignificant where the present value of cash flows from the settlement or realisation of working capital items would be similar to the balances themselves. However, in estimating future cash flows for VIU purposes, material changes in future working capital requirements associated with the asset or CGU under review need to be considered.

Careful consideration must be given to inventory. The basic approach would be to exclude inventory balances from the impairment review as it is excluded from the scope of IAS 36 (and addressed in IAS 2 ‘Inventories’). Under this approach, the estimated future cash flows from future sales of the inventory held at the measurement date should be excluded when estimating VIU. Where management includes inventory in its VIU calculation for practical reasons, it will include the estimated future cash flows from future sales of the inventory. An adjustment may be necessary for gross margins, where deemed significant.

The order of impairment testing for corporate assets and goodwill

IAS 36 specifies the order of testing in three circumstances:

| Circumstances requiring guidance on order of testing | See the relevant section below |

| When a corporate asset cannot be allocated on a reasonable and consistent basis to the unit under review | Order of testing for corporate assets that cannot be allocated |

| When assets within a CGU to which goodwill has been allocated are tested for impairment at the same time as the unit | Order of testing for assets and cash generating units to which goodwill has been allocated |

| If a CGU making up a group of CGUs to which goodwill has been allocated is tested for impairment at the same time as the group of units | Order of testing for assets and cash generating units to which goodwill has been allocated |

Order of testing for corporate assets that cannot be allocated

Our article ‘IAS 36 – Identifying cash-generating units’ discusses the process of allocating corporate assets to a CGU. If a portion of the carrying amount of a corporate asset can be allocated on a reasonable and consistent basis, the carrying amount of the CGU, including the portion of the carrying amount of the corporate asset allocated, is compared with its recoverable amount.

The assessment becomes more complex where a portion of the carrying amount of a corporate asset cannot be allocated on a reasonable and consistent basis to an individual CGU being tested. In this case, the entity should:

- compare the carrying amount of the unit, excluding the corporate asset, with its recoverable amount and recognise any impairment loss

- compare the carrying amount of the smallest group of CGUs under review to which a portion of the carrying amount of the corporate asset can be allocated on a reasonable and consistent basis and compare that amount with the recoverable amount of the group of units and recognise any impairment loss [see step 2 in the example below]. Any additional impairment loss calculated in this step should be recognised as follows:

- to reduce the carrying amount of any goodwill allocated to the CGU (or groups of CGUs)

- to the other assets of the CGU (or groups of CGUs) pro rata based on the carrying amount of each asset in the CGU (or groups of CGUs)

- when all or part of the corporate asset remains untested, the entity should test for impairment on an entity-wide basis and follow the same allocation process as outlined in bullet 2 above for any additional impairment calculated at this level.

The example below depicts the order of testing where the corporate asset cannot be allocated on a reasonable and consistent basis, other than on an entity-wide level.

Order of testing for assets and cash generating units to which goodwill has been allocated

If certain assets forming part of a CGU to which goodwill has been allocated are tested for impairment at the same time as the CGU, these assets are tested before the CGU as a whole is tested. This enables the entity to isolate any impairment at an individual asset level (if applicable) before proceeding to test at the CGU level. This requirement would apply only when the entity:

- is required to test the individual asset (eg because an impairment indicator has been identified)

- it is possible to determine the asset’s recoverable amount even though it is part of a CGU (eg an asset that does not generate largely independent cash flows but whose recoverable amount is estimated based on FVLCOD).

Similarly, if a group of CGUs to which goodwill has been allocated is tested for impairment at the same time as the individual CGUs, the individual CGUs are tested for impairment before the group of CGUs.

Not adhering to the prescribed order of testing in these particular cases will usually result in a different allocation of any impairment loss among the individual assets or CGUs. Step 6 discusses the allocation of impairment losses in more detail.