SGX’s SPAC framework provides companies an alternative capital fund raising route with greater certainty on price and execution.

SGX is one of the most progressive and leading stock exchanges in Asia Pacific region and the new listing rules will give a much-needed boost to Singapore’s capital markets. The SPAC listing rules will also make SGX a viable platform for fast-growing companies.

What is a SPAC?

- A Special Purpose Acquisition Company, or SPAC, presents opportunities for private companies to go public, usually without the long process associated with an Initial Public Offering (IPO).

- A SPAC works by raising capital from public capital through an IPO for the purpose of acquiring or merging with an existing company (usually a private company). SPACs typically have no commercial operations before acquiring a private company.

- On listing, substantial part of the gross IPO funds are placed in an escrow account and are used to acquire an existing company.

- Once a target is identified, a simple majority of independent directors and shareholders is required in support of the transaction.

- SGX rules require prospectus-level disclosures for acquisitions including on key areas such as:

- financial position and operating control

- character and integrity of the incoming directors and management

- compliance history

- material licences, permits and approvals required to operate the business

- resolution of conflicts of interests

- SPAC transactions often involve seller shareholders retaining some interest in combined entity. Once the acquisition is complete, the combined entity is a publicly traded entity and is governed by a board of directors which often include the SPAC sponsors (or their representatives), and sellers (or their representatives).

- The funds are returned if no acquisition is made in two years from listing date.

SPAC transactions can give rise to unique financial reporting and accounting issues under Singapore Financial Reporting Standards (International) (SFRS(I)s).

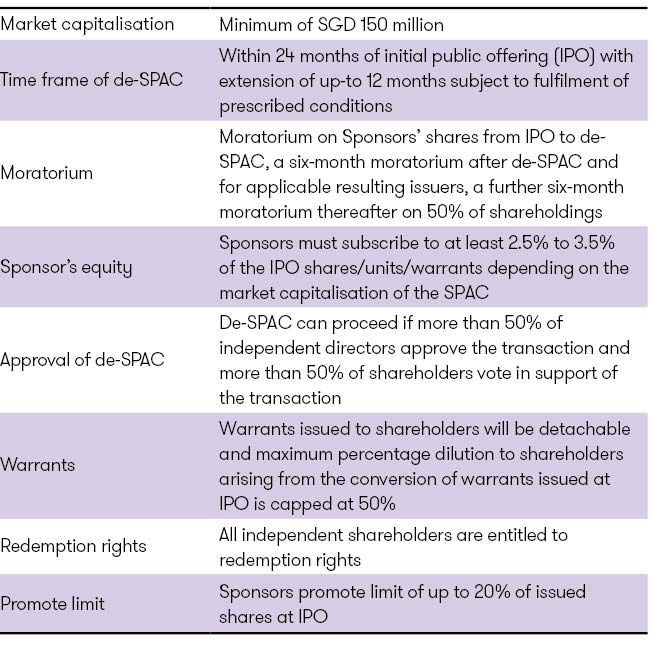

Key features of SPAC listing framework

Key accounting considerations in SPAC transactions

A SPAC’s life cycle involves the IPO of the SPAC and subsequent acquisition of the target which raises many financial reporting issues which includes the issues of identification of the accounting acquirer in the transaction, the accounting for financial instruments and share-based payment transactions before and after the acquisition.

Is the transaction a business combination?

When a SPAC obtains control of a business, the reporting entity may have to apply the acquisition method of accounting for the assets and liabilities of the acquired business under SFRS (I) 3. The acquisition method of accounting results in recognising all of the acquired identifiable assets and liabilities of the business (with limited exceptions) at fair value.

This method may also result in the acquirer recognising goodwill or, in limited circumstances, a bargain purchase gain.

Answering this question involves determining:

- which company is the ‘accounting acquirer’ under SFRS (I) 3, i.e. the company that obtains effective control over the other

- whether or not the acquired company (i.e. the ‘accounting acquiree’ under IFRS 3) is a business.

In these transactions, the pre-combination shareholders of the target company typically obtain a majority (controlling) interest, with the pre-combination shareholders of the SPAC retaining a minority (non-controlling) interest. This usually indicates that the target company is the accounting acquirer.

If the SPAC is the accounting acquiree, the next step is to determine whether it is a ‘business’ as defined in SFRS (I) 3. The SPAC may not be considered a business if its activities are limited to managing cash balances and filing obligations.

Further analysis will be needed if the SPAC undertakes other activities and holds other assets and liabilities. Determining whether the listed company is a business in these more complex situations typically requires judgement.

An acquisition in which an operating company obtains effective control over a SPAC that is not a business would not be considered a business combination under SFRS (I).

Accounting when the transaction is not a business combination

Although a reverse acquisition of a ‘non-business’ SPAC is not a business combination, the SPAC becomes a legal parent and continues to have filing obligations. Accordingly, SFRS (I) 10 requires it to prepare consolidated financial statements.

The Management therefore needs to develop an accounting policy to address the basis of preparation of the consolidated financial statements. These consolidated financial statements may be prepared using the reverse acquisition methodology by analogy, but without recognising goodwill. Specifically,

- the consolidated financial statements of the legal parent (SPAC) are presented as a continuation of the financial statements of the operating company (the Target, which is considered the accounting acquirer)

- the deemed acquisition cost should be allocated to the identifiable assets and liabilities of the SPAC on the basis of their fair values at the date of purchase

- any excess of the deemed acquisition cost over the fair value of the assets and liabilities of the SPAC represents a share-based payment made in exchange for obtaining a listing. This should be accounted for as an expense in accordance with SFRS (I) 2

- in some rare situations, the total fair value of identified assets and liabilities may exceed the deemed cost. If so, the recognised values of the assets and liabilities should be reduced on a pro-rata basis so that they equal the deemed acquisition cost

- any other transaction costs incurred should be allocated between the costs of a new issue of equity shares and the cost of obtaining a listing

- no goodwill is recognised.

Get more details and examples for transactions that are not business combinations. Read IFRS Viewpoint: Reverse acquisitions outside the scope of IFRS 3.

Accounting when the transaction is a business combination

When the SPAC is the accounting acquiree and is also a business for SFRS (I) 3 purposes, SFRS (I) 3’s reverse acquisition approach applies in full. Goodwill is then recognised to the extent the deemed acquisition cost exceeds the fair value of the listed company’s identifiable assets and liabilities.

Although some of the deemed acquisition cost might, in substance, relate to the cost of obtaining a listing, this amount is subsumed into goodwill.

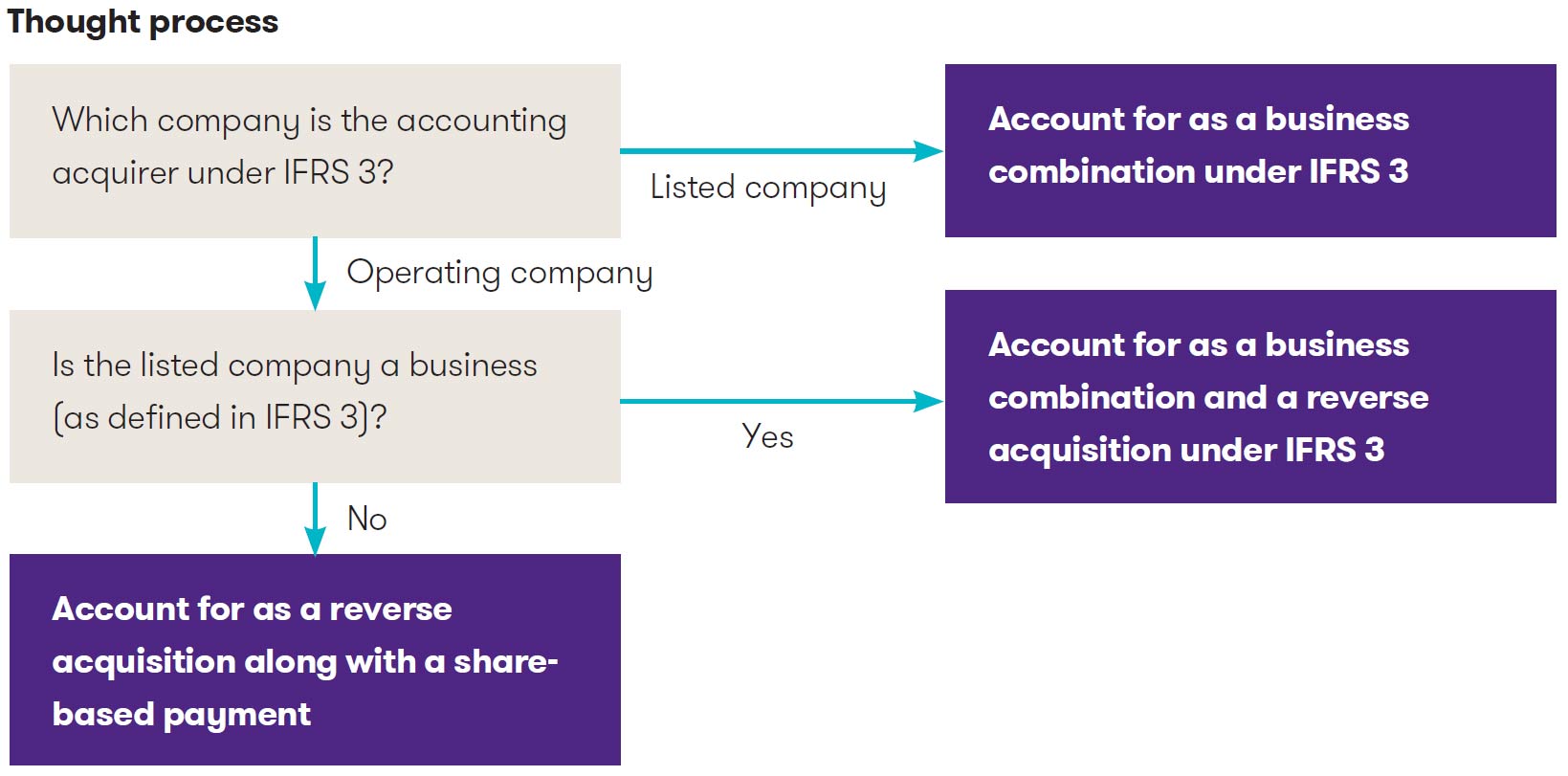

When the listed company is identified as the accounting acquirer, the normal SFRS (I) 3 acquisition accounting principles apply. The diagram above summarises the thought process.

Identifying the accounting acquirer

An important step in every business combination is determining which one of the combining entities is the acquirer for accounting purposes.

SFRS (I) 3 provides a framework for identifying the acquirer. This requires an entity to exercise judgment and might result in identifying an entity other than the legal acquirer as the acquirer for accounting purposes.

An entity that obtains control of the acquiree business or businesses in a business combination is the acquirer as per SFRS (I) 3. Determining the accounting acquirer in a SPAC acquisition requires careful assessment and significant judgement.

While some indicators in SFRS (I) 3 may suggest that the SPAC is the accounting acquirer, others may suggest that the target is the accounting acquirer. Determining the accounting acquirer requires assessment of following indicators:

- Relative voting rights in the combined entity after the business combination

- Existence of a large minority voting interest in the combined entity if no other owner or organized group of owners has a significant voting interest

- Composition of the governing body of the combined entity

- Composition of the senior management of the combined entity

- Terms of the exchange of equity interests

Once the accounting acquirer is identified, the guidance mentioned in the previous section should be considered to determine the appropriate accounting treatment.

The following additional points need careful assessment and accounting.

Get more details and examples for transactions that are business combinations. Read IFRS Viewpoint: Reverse acquisitions in the scope of IFRS 3.

Join our mailing list to keep updated on changes in the financial reporting landscape