Accounting implications for CFOs

The COVID-19 global pandemic has resulted in economic consequences that many reporting entities may not have had to previously consider. One of those consequences is their ability to repay loans. In response, some lenders have agreed to changing the borrowing terms or providing waivers or modifications to debt covenant arrangements. Any changes to the terms of loan agreements, for example providing any kind of payment holidays on either principal or interest or changing interest rates, should be carefully assessed.

Borrowers need to determine the impact of these changes and then apply the guidance set out in IFRS 9 ‘Financial Instruments’ to determine whether the change is a modification (as defined in IFRS 9). In many instances, a gain or a loss might need to be recorded in profit or loss and depending on facts and circumstances, derecognition of the financial arrangement might be required as a result of modifying the financial instrument arrangement that existed.

Debt modification accounting

Debt restructuring can take various legal forms including:

- an amendment to the terms of a debt instrument (eg the amounts and timing of payments of interest and principal) or

- a notional repayment of existing debt with immediate re-lending of the same or a different amount with the same counterparty. The borrower will usually incur costs in a debt restructuring, and other fees might also be paid or received. The accounting for the debt modification depends on whether it considered to be ‘substantial’ or ‘non-substantial’.

There are two tests to check whether the modification is substantial, and these are as follows:

- Qualitative test - A significant change in the terms and conditions such that immediate derecognition is required with no additional quantitative analysis.

Examples of this type of modification include issuing new debt in different currency from old debt, or equity instrument embedded in the new debt. - Quantitative test - The net present value of the cash flows under the new terms discounted at the original effective interest rate (EIR) is at least 10% different from the carrying amount of the original debt. This is described as the ‘10% test’.

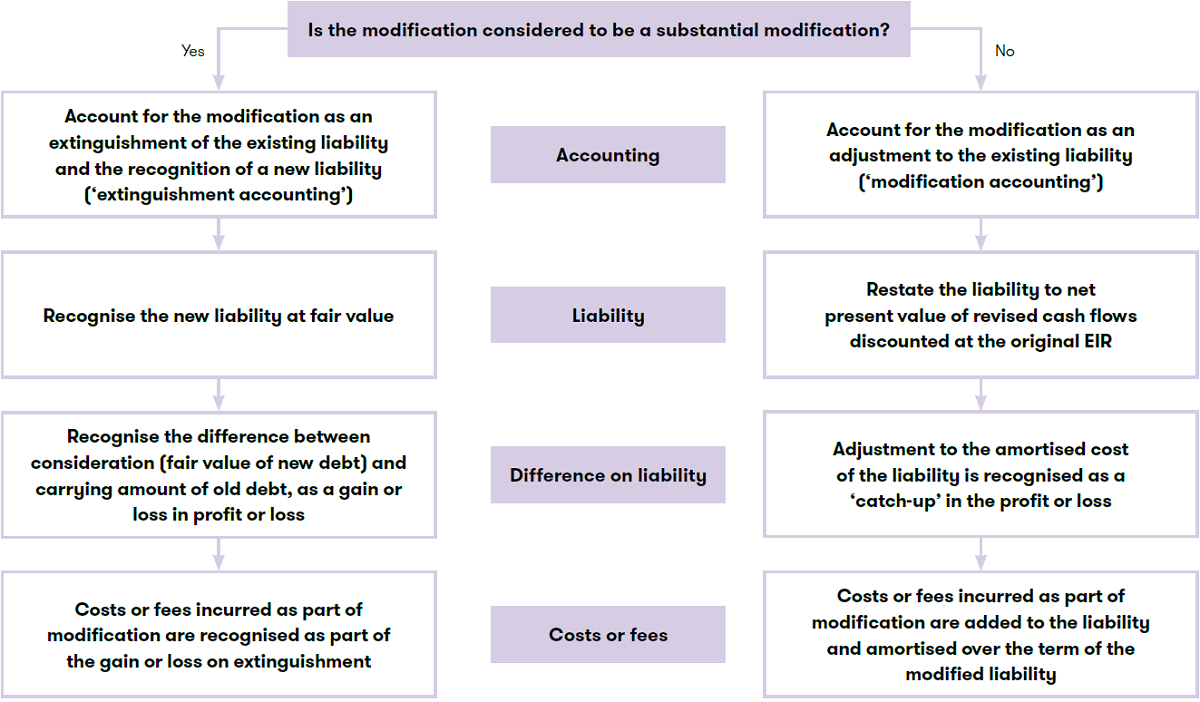

The following flowchart sets out how to assess whether or not a debt modification is substantial:

The role of fees in the 10% test

As mentioned above, if the ‘10% test’ is exceeded in the quantitative test, this results in a substantial modification. IFRS 9 states this test should compare the discounted present value amount of the cash flows under the new term, including any fees paid net of any fees received, discounted at the original EIR, with the discounted present value amount of the remaining cash flows of the original liability.

As this test is comparing the extent of the change between borrower and lender, the reference to fees in this context should refer to the fees between borrower and lender (eg would not normally include fees paid a lawyer). This was clarified by an amendment to IFRS 9 in the ‘Annual Improvements to IFRS Standards 2018-2020 [ 231 kb ]’ issued on 14 May 2020. Whereas above, in the final step, the fees included as an adjustment to the EIR are all fees, including external fees (such as lawyer fees).

In addition, these amendments also clarify that when the exchange or modification is not accounted for as an extinguishment, any costs or fees incurred adjust the carrying amount of the liability and are amortised over the remaining term of the modified liability. If they are accounted for as an extinguishment, they are recognised as part of the gain or loss on the extinguishment that should be recognised in profit or loss.

Modification accounting

IFRS 9 contains guidance on non-substantial modifications and the accounting in such cases. It states that costs or fees incurred are adjusted against the liability and are amortised over the remaining term. That same guidance is silent on other changes in cash flows. Prior to IFRS 9, IAS 39 ‘Financial Instruments: Recognition and Measurement’ included similar guidance, and under IAS 39 it was common for entities to account for non-substantial modifications on a ‘no gain no loss’ basis.

However, IFRS 9 clarifies in the Basis for Conclusions the IASB intends that adjustments to amortised cost in such cases should be recognised in profit or loss. This is the consequence of applying IFRS 9, according to which the liability should be restated to its revised future cash flows discounted by the original EIR.

Fees paid in a non-substantial modification

As explained above, in a non-substantial modification, the liability is restated based on the net present value of the revised cash flows discounted at the original EIR. This amount is compared to the previous carrying amount and the difference is recognised in the profit or loss. However IFRS 9 specifically states in its application guidance, that costs or fees incurred are adjusted against the carrying amount. Such costs or fees therefore have some impact of altering the EIR rather than being recognised in the profit or loss.

Where the counterparty bank is paid an amount which is described as a fee, it would appear contradictory to IFRS 9 to amortise this. In our view, fees to third parties such as lawyers fees should be amortised (and the EIR adjusted). However, we believe fees paid to the counterparty bank that represent part of the cash flows should normally be accounted for in the same way as other as other cash flows on the debt instrument, which would lead to such fees being part of the gain or loss rather than amortised over the remaining life of the loan.

Assume the same scenario as the first example, however there are two additional facts. As part of this modification the entity:

- incurs a CU 10,000 arrangement fee from the bank

- incurs CU 5,000 of legal fees.

Analysis

The entity carries out the 10% test:

The net present value of the future cash flows, (discounted at the original EIR inclusive of fees paid to the lender) is CU 976,000 plus CU 10,000 = CU 986,000.

For the purposes of the 10% test this is compared to CU 1,000,000 giving only a 1.4% difference. This is less than 10%, so the loan modification (waiver of 6 months of interest) considered to be a non-substantial modification.

However, for the purposes of the accounting entries, our view is the fees to the lender should be expensed while the legal fees should be amortised as explained above.

Therefore, the following journal entries should be recorded:

| Journal: | CU | CU |

| Dr Existing liability | 24,000 | |

| Cr Profit or loss (modification gain) | 24,000 | |

| Cr Cash (costs and fees paid) | 15,000 | |

| Dr Existing liability (legal fees) | 5,000 | |

| Dr Profit or loss (bank fees) | 10,000 |

Extinguishment accounting

Extinguishment accounting involves:

- de-recognition of the existing liability

- recognition of the new or modified liability at its fair value

- recognition of a gain or loss equal to the difference between the carrying value of the old liability and the fair value of the new one. Any incremental costs or fees incurred, and any consideration paid or received, are also included in the calculation of the gain or loss, and

- calculating a new EIR for the modified liability, that is then used in future periods. This rate would normally equate to the market rate of interest used in the fair value calculation (see below).

The fair value of the modified liability will usually need to be estimated. It cannot be assumed that the fair value equals the book value of the existing liability. The fair value can be estimated based on the expected future cash flows of the modified liability, discounted using the interest rate at which the entity could raise debt with similar terms and conditions in the market.

One effect of extinguishment accounting is the accelerated ‘expensing’ of transaction costs. This is because the unamortised portion of any transaction costs deducted from the original loan is included in the determination of the gain or loss on extinguishment. Any additional fees or costs incurred on modification are also included in the gain or loss.

There are some narrow exceptions to this, but generally this is only where the fees do not clearly relate to the modification, but are incremental to issuing the new debt that is payable to a party other than the lender, eg stamp duty paid on new financial instrument that is put in place.

Entity X has a non-amortising loan of CU 10,000,000 from the bank. Interest is set at a fixed rate of 5%, which is payable quarterly. Maturity date is 31 December 2025.

On 1 July 2020 the bank agrees to waive interest for two quarterly periods from 1 July 2020 to 31 December 2020. In addition, the contractual rate of interest is increased to 8% starting 1 January 2021.

As part of the modification, the entity pays a CU 150,000 arrangement fee to the bank and a CU 50,000 professional service fee to its lawyers.

Analysis

The entity carries out the 10% test:

- the net present value of the future revised cash flows, discounted at the original EIR inclusive of fees paid to the lender is CU 10,990,426 plus CU 150,000 which is equal to CU 11,140,426.

- for the purposes of the 10% test this is compared to CU 10,000,000 giving an 11.4% difference. This is more than 10%, so the loan modification (waiver of 6 months of interest and subsequent increase of the contractual interest rate) is considered to be a substantial modification.

- the legal fees are judged not to be incremental to the issue of the new debt, as they include elements relating to advice on the pre-existing debt’s contractual terms.

The initial liability has to be extinguished and a new liability recognised at its fair value as of the date of the modification. Given the market rate of interest is 12% for a comparable liability, the fair value of the liability amounts to CU 8,122,994. The difference of CU 1,877,006 between this initial fair value of the new liability and the carrying amount of the liability derecognised (CU 10,000,000) is recognised as a gain upon extinguishment. All fees incurred (CU 200,000) are immediately expensed, thus reducing the amount of the net gain upon extinguishment to CU 1,677,006.

Therefore, the following journal entries should be recorded:

| Journal: | CU | CU |

| Dr Existing liability | 10,000,000 | |

| Cr New liability | 8,122,994 | |

| Cr Cash (bank and legal fees paid) | 200,000 | |

| Cr Profit or loss (gain on extinguishment) | 1,667,006 |

How Grant Thornton can help

Preparers of financial statements will need to be agile and responsive as the situation unfolds. Having access to experts, insights and accurate information as quickly as possible is critical – but your resources may be stretched at this time. We can support you as you navigate through accounting for the impacts of COVID-19 on your business. Now more than ever the need for businesses, their auditor and any other accounting advisors to work closely together is essential. In this article is general information, not specific advice. However, if you would like to discuss any of the points raised, please speak to your usual Grant Thornton contact orour FRAS expert.