-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

The COVID-19 pandemic is requiring those responsible for the preparation of financial statements to reconsider whether assumptions and assessments previously made are still valid and appropriate which in turn is creating an additional burden on entities all over the world. In particular, IFRS 16 has become an area of focus for entities and the International Accounting Standards Board (IASB).

The IASB has therefore added a practical expedient to provide relief for lessees from lease modification accounting for rent concessions related to COVID-19. We explain the current accounting requirements, the practical expedient and how to apply it.

Download COVID-19 accounting for lease modifications [ 117 kb ]

Lessors are providing lessees with rent concessions. These can be in the form of rent holidays or rent reductions for an agreed timeframe (possibly followed by increased rentals in future periods). In some jurisdictions, governments are making rent concessions a requirement. In others they are merely encouraging them. These concessions will have major impact for some lessees, particularly in the retail and hospitality industries which in many cases have been forced to temporarily close their premises.

IFRS 16 contains specific requirements on accounting for lease modifications. Rent concessions that change the overall consideration for the lease are in the scope of these requirements. Lessees are currently required to assess whether rent concessions are lease modifications and, if they are, apply specific accounting guidance. This can be burdensome, especially for large portfolios of leases with different features and different types of concessions. Entities already have significant pressures upon them as a result of this pandemic and what is set out in IFRS 16 just adds to the burden.

Lessor modifications

Finance leases

Lessor accounting for modification of finance leases is detailed in IFRS 16.79 to 80. Similar to lessee accounting, when the scope of a lease increases and the consideration changes commensurately, a separate lease exists. Where this is not the case, the lessor must:

- reassess the accounting for the lease and determine if the lease would have been considered an operating lease if the modification had been known; and, if so:

- create a new lease from the effective date of the modification; and

- reclassify the lease receivable balance at the date of modification to property, plant and equipment

- where the lease remains a finance lease, the lease receivable is remeasured by the application of IFRS 9. In such a case, assuming that that the receivable is classified as amortised cost, the change in future cash flows is a remeasurement event resulting in a gain or loss within profit or loss applying the catch-up guidance (ie discounting the revised contractual cash flows using the original discount rate).

Operating leases

IFRS 16 provides only limited guidance on modification of operating leases from a lessor’s perspective. It requires that any modification be considered a new lease, and that any remaining prepayments and accruals are included in the accounting for this new lease. IFRS 16 does not state whether balances arising from the lessor’s straight-lining calculation are considered to be accruals or prepayments but our view, consistent with the approach when applying IAS 17, is that they are.

In such an instance, if the new lease continues to be classified as operating, the future cash flows are recognised on a straight line (or other systematic) basis, adjusted for any prepayments or accruals. The expense recognition pattern should ensure the balance is written down to zero at the end of the lease. Another systematic basis could be that, for example, the pattern of recognition of the lease income reflects the lease payments. So if there was a three-month rent-free period, no lease income would be recognised for that three-month period.

Impairment

Due to the decrease in estimated future cash flows, impairment indicators may exist such that impairment of the individual assets should be considered.

Lessee modifications

Reasssessment vs modification

Lease modification and reassessment of the lease liability are two different concepts with potentially different accounting outcomes. Generally, a reassessment takes place when there are changes in lease payments based on contractual clauses included in the original contract – such as changes in CPI, a market price adjustment, a change in any price guarantee arrangement that might appear in the lease contract (IFRS 16.42). In such an instance, future cash flows are reforecast and present-valued utilising the discount rate set in the initial measurement of the lease (IFRS 16.43).

A lease modification (as considered in this document – does not address changes in leased asset, such as decreases in leased space) arises when the lease contract is altered such that future cash flows and/or the scope of the lease change. Where an increase in scope occurs, and the payment for this increase in scope is commensurate, a separate lease is accounted for (IFRS 16.44).

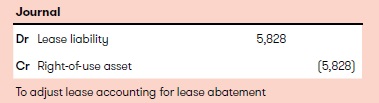

Otherwise, the original lease is remeasured by:

- identifying a revised discount rate appropriate to the revised lease term, underlying asset and the lessee

- determining the net present value of future cash outflows using that revised discount rate

- adjusting the remaining right-of-use asset for the increase or decrease in the lease liability. If the adjustment exceeds the carrying value of the right-of-use asset this excess is recognised as a gain in profit or loss.

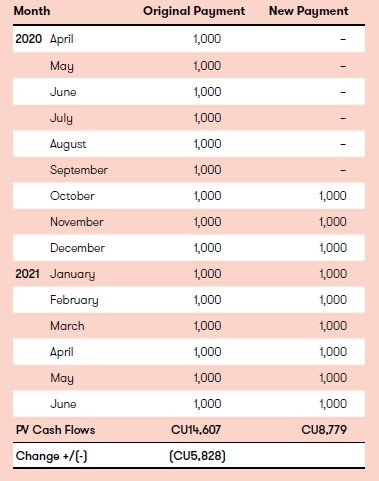

RetailCo closed its stores on 15 March 2020. Economic and regulatory circumstances changed on 30 June 2020 such that RetailCo wished to reopen its stores, however, the significant period of time with no cash inflow resulted in insufficient working capital to meet its lease obligations.

On 1 April 2020, RetailCo received a 6-month lease abatement from its landlord, starting 1 April and expiring 30 September 2020. RetailCo’s incremental borrowing rate was 4% at lease inception; it is now 6% because its credit rating has fallen. Payments were CU1,000 per month, expiring in 30 June 2021. Renegotiated payments remain consistent. Payments are in arrears.

At 1 April 2020, the balance of the right-of-use asset was CU15,000. The Liability balance was CU14,607.

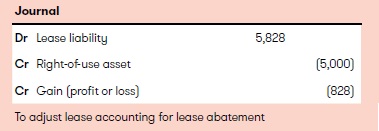

Decrease in lease liability > right-of-use asset

If the right-of-use asset had been CU5,000 at the date of modification, the decrease (CU5,828) is more than the right-of-use asset. In such a case, a gain is recognised:

The practical expedient

The practical expedient bypasses the need for lessees to carry out an assessment to determine whether a COVID-19 related rent concession received is a lease modification or not. The lessee accounts for the rent concession as if the change was not a lease modification. However, there are no changes for lessors.

The practical expedient is only applicable to rent concessions provided as a direct result of the COVID-19 pandemic. In addition, the relief is only for lessees that are granted these rent concessions. All of the following conditions in relation to permitting a lessee to apply the practical expedient need to be met:

- the rent concession provides relief to payments that overall results in the consideration for the lease contract being substantially the same or less than the original consideration for the lease immediately before the concession was provided.

- the rent concession is for relief for payments that were originally due on or before 30 June 2021. So payments included are those that are reduced or deferred on or before 30 June 2021, but any subsequent rental increases of amounts deferred can go beyond 30 June 2021.

- there are no other substantive changes to the other terms and conditions of the lease.

Disclosure

If applying the practical expedient, the amendments require the entity to disclose:

- that it has applied the practical expedient to all its rent concessions, or if only some of them, a description of the nature of the contract it has applied the practical expedient to

- the amount in profit or loss for the reporting period that reflects the change in lease payments arising from rent concessions (as a result of applying the practical expedient).

Effective date

The amendment is applicable for reporting periods beginning on or after 1 June 2020. Earlier application will be permitted, including for financial statements not yet authorised for issue at 28 May 2020 (the date the amendment was issued).

Some practical examples of where the practical expedient might be used are where payments:

- are deferred for a period of time, and then increased at a future date

- are forgiven completely for a period of time

- are partly deferred and partly forgiven, and then partly increased at a future date.

A concession that simply defers rentals payments to a later date is not necessarily a modification based on the IASB’s recent education guidance. The changes in the practical expedient are however still useful as they avoid the lessee having to assess whether or not modification accounting applies.

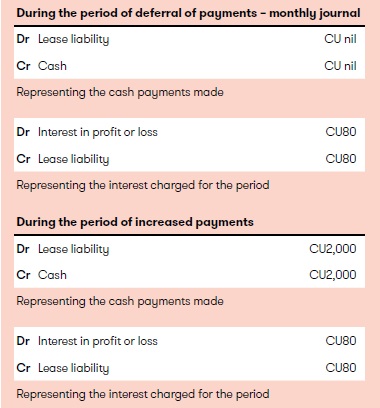

Scenario

A lessee is paying monthly lease payments of CU1,000. The lessor has agreed to defer 6 months of lease payments from 2020 to 2021 as a result of COVID-19. Assume interest accrues at CU80 per month and the 6 months increased lease payments of CU2,000 commence on 1 April 2021 and continue until 30 September 2021.

The lease liability at the end of the period where payments were increased would be the same as if the payments had not been altered at all.

During both periods, in our view, amortisation should be charged on the right-of-use asset as normal.

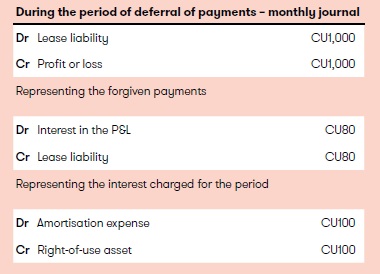

Scenario

A lessee is paying monthly lease payments of CU1,000. The lessor has agreed to forgive 6 months of payments in 2020 with no adjustment to future rentals. Assume interest accrues at CU80 per month. Monthly depreciation is CU100.

In our view, the preferred presentation of the credit within profit or loss is to follow the accounting policy for variable lease payments. However, we do believe there is an argument to present the credit as a financial item, as ‘debt forgiveness’. As long as it is appropriately disclosed, in our view either treatment would be acceptable.

How Grant Thornton can help

Preparers of financial statements will need to be agile and responsive as the situation unfolds. Having access to experts, insights and accurate information as quickly as possible is critical – but your resources may be stretched at this time. We can support you as you navigate through accounting for the impacts of COVID-19 on your business.

Now more than ever the need for businesses, their auditors and any other accounting advisors to work closely together is essential. If you would like to discuss any of the points raised, please speak to your usual Grant Thornton contact or your local member firm.