-

Accounting Advisory

Our accounting advisory team help businesses meet their complex financial reporting requirements. The team can support in applying new financial reporting standards, IFRS/ US GAAP conversions, financial statement preparation, consolidation and more.

-

Payroll

Our team can handle your payroll processing needs to help you reduce cost and saves time so that you can focus on your core competencies

-

Managed accounting and bookkeeping

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Accounting Advisory

Our team helps companies keep up with changes to international and domestic financial reporting standards so that they have the right accounting policies and operating models to prevent unexpected surprises.

-

Crypto Accounting Advisory Service

Our team can help you explore appropriate accounting treatment for accounting for holdings in cryptocurrencies, issuance of cryptocurrencies and other crypto/blockchain related accounting issues.

-

ESG Reporting and Accounting

As part of our ESG and Sustainability Services, our team will work with you on various aspects of ESG accounting and ESG reporting so that your business can be pursue a sustainable future.

-

Expected Credit Loss

Our team of ECL modelling specialists combine help clients implement provisioning methodology and processes which are right for them.

-

Finance Transformation

Our Finance Transformation services are designed to challenge the status quo and enable your finance team to play a more strategic role in the organisation.

-

Managed Accounting and Bookkeeping Services

Outsourcing the financial reporting function is a growing trend among middle market and startup companies, as it provides a cost-effective way to improve the finance and accounting function. Our team can help with financial statement preparation, consolidation and technical on-call advisory.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Finance

Our corporate finance team helps companies with capital raising, mergers and acquisitions, private equity, strategic joint ventures, special situations and more.

-

Financial Due Diligence

From exploring the strategic options available to businesses and shareholders through to advising and project managing the chosen solution, our team provide a truly integrated offering

-

Valuations

Our valuation specialists blend technical expertise with a pragmatic outlook to deliver support in financial reporting, transactions, restructuring, and disputes.

-

Sustainability with the ARC framework

Backed by the CTC Grant, businesses can tap on the ARC Framework to gain access to sustainability internally, transform business processes, redefine job roles for workers, and enhance productivity. Companies can leverage this grant to drive workforce and enterprise transformation.

-

Business Tax Advisory

Our business tax team can help you navigate the international tax landscape, grow through mergers and acquisitions, or plan an exit strategy.

-

Corporate Tax Compliance

Our corporate tax teams prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and realise tax benefits.

-

Tax Governance

Our Tax Governance Services are designed to assist organisations in establishing effective tax governance practices, enabling them to navigate the intricate tax environment with confidence.

-

Goods and Services Tax

Our GST team supports organisations throughout the entire business life-cycle. We can help with GST registration, compliance, risk management, scheme renewals, transaction advisory and more.

-

Transfer Pricing

Our Transfer Pricing team advises clients on their transfer pricing matters on and end-to-end basis right from the designing of policies, to assistance with annual compliance and assistance with defense against the claims of competing tax authorities.

-

Employer Solutions

Our Employer Solutions team helps businesses remain compliant in Singapore as well as globally as a result of their employees' movements. From running local payroll, to implementing a global equity reward scheme or even advising on the structure of employees’ cross-border travel.

-

Private Client Services

Our private client services team provides a comprehensive cross section of advisory services to high net worth individuals and corporate executives, allowing such individuals to concentrate on their business interests.

-

Welfare and benefits

We believe that a thriving team is one where each individual feels valued, fulfilled, and empowered to achieve their best. Our welfare and benefits aim to care for your wellbeing both professionally and personally.

-

Career development

We want to help our people learn and grow in the right direction. We seek to provide each individual with the right opportunities and support to enable them to achieve their best.

In today's world, the urgency of sustainability cannot be overstated. Businesses and organisations are increasingly realising the critical importance of reporting on their ESG performance. Sustainability reporting is not just about transparency and accountability; it's a catalyst for driving sustainable practices and policies that our planet desperately needs.

Leading the charge in this mission is the GRI, an international standards organisation. With a 93% global adoption rate since 1997, GRI is the most widely used global standard for sustainability reporting today. With GRI Standards, organisations can step up, comprehend, manage, and shout about their sustainability efforts, contributing to a global economy that's both sustainable and crystal-clear.

Discovering the GRI Standards

The GRI Standards are not just another set of guidelines; they are a universal language for organisations, big or small, private or public, to share their sustainability impacts consistently and credibly.

They provide a holistic framework for organisations to grasp and communicate their influence on the economy, environment, and society, encompassing vital areas such as human rights and climate change. They don't just enhance transparency; they empower organisations to make more sustainable decisions through better insights into their operations.

Investors, policymakers, capital markets, and civil society all gain valuable insights. Investors, for example, use GRI Standards to gauge a company's sustainability performance and make informed investment decisions.

GRI Standards drive sustainable development by enabling organisations to report their contributions to the Sustainable Development Goals (SDGs). By providing a clear picture of an organisation's material topics, related impacts, and how they're managed, GRI Standards help organisations align with the SDGs to make the world a better place.

Unpacking the Components of the GRI Standards

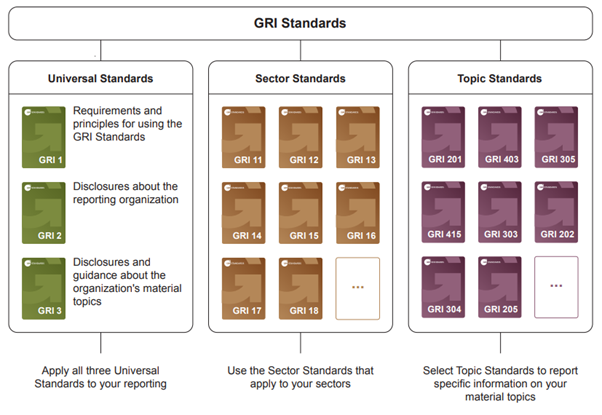

The GRI Standards come in three interconnected series: Universal Standards, Sector Standards, and Topic Standards. Together, they paint a complete picture of an organisation's material topics, their impacts, and how they're handled.

Universal Standards

Universal Standards are the foundation of sustainability reporting, applicable to all organisations. These standards have been updated to incorporate human rights and environmental due diligence.

In a world of intergovernmental expectations, they encourage all organisations, regardless of their size or industry, to report on these crucial areas. Universal Standards offer a comprehensive view of an organisation's sustainability impacts, including general disclosures about the organisation's profile, strategy, and approach to managing material topics.

Sector Standards

A major innovation in the recent update of GRI Standards is the introduction of Sector Standards. They provide consistent reporting on sector-specific impacts, addressing the unique sustainability challenges within specific industries and economic sectors. These sectors range from Oil and Gas to Banking, from Renewable Energy to Metal Processing.

Topic Standards

Topic Standards specify disclosures relevant to a particular sustainability topic, such as water, energy, or labour practices. They provide specific guidance on reporting impacts related to these topics. The recent update streamlined the number of Topic Standards from 34 to 31, integrating discontinued topics into aspects of the Universal Standards.

The 2021 Update to the GRI Standards

The 2021 update brought significant changes to the GRI Standards. Notably, the Topic Standards were reduced from 34 to 31, eliminating redundancies and streamlining the reporting process. The most significant addition was the introduction of Sector Standards, designed to ensure consistent reporting on sector-specific impacts.

This change reaffirmed GRI's commitment to maintaining an up-to-date framework for sustainability reporting, ready to address sector-specific complexities while remaining steadfast in its focus on universal sustainability topics like human rights and environmental stewardship.

Using the GRI Standards

GRI 1 (concepts, principles, and reporting compliance requirements): The GRI Standards journey begins with GRI 1, laying the foundation by explaining key concepts, principles, and reporting compliance requirements. Identifying an organisation's impacts is an ongoing process, shaped by its unique context.

The Sector Standards come to the rescue by outlining sector-specific impacts, providing guidance for organisations to assess their own impacts.

GRI 2 (information about reporting practices and other details) and GRI 3 (step-by-step guidance on how to determine material topics): GRI 2 and GRI 3 guide organisations in evaluating the significance of their impacts based on their unique context. They help in identifying and assessing impacts and their significance.

Once the organisation understands its impacts, it must decide which ones to report. GRI 3 aids in prioritising and categorising impacts into material topics. The Sector Standards also help in determining material topics by comparing them to relevant standards.

Reporting using the GRI Standards

Data Collection

Urgently, the next critical step is to gather data for reporting, as the Topic Standards dictate the mandatory disclosures for GRI Standards-based reporting.

The GRI Standards offer organisations the vital opportunity to comprehensively report on their significant impacts or zero in on specific issues.

Delivering impacts through data and insights

It is absolutely imperative to emphasise that reporting in line with the GRI Standards and other recognised frameworks is not just a mere formality. Far too often, organisations get sidetracked by their reporting obligations, losing sight of the fundamental reasons behind their reporting efforts.

While a powerful regulatory push for increased ESG disclosure exists, companies must also recognise that they report to gain deeper insights into their preparedness for managing emerging risks. These risks, be they transient or physical in nature, demand immediate attention from organisations.

Conclusion

The GRI Standards can be your ally in the quest for sustainability and transparency. Its flexibility, comprehensiveness, and regular updates make it a useful tool for organisations committed to making a positive impact in this ever-changing world. These standards are not just tools; they are the drivers of a more sustainable and transparent future.

Images from https://www.globalreporting.org/media/wtaf14tw/a-short-introduction-to-the-gri-standards.pdf