The release of the 7th edition of the Singapore Transfer Pricing Guidelines (Singapore TP Guidelines, or ‘the Guidelines’) on 14 June 2024 signifies a substantial advancement in the efforts of the Inland Revenue Authority of Singapore (IRAS) to enhance clarity and rigour in the Singapore transfer pricing (TP) landscape.

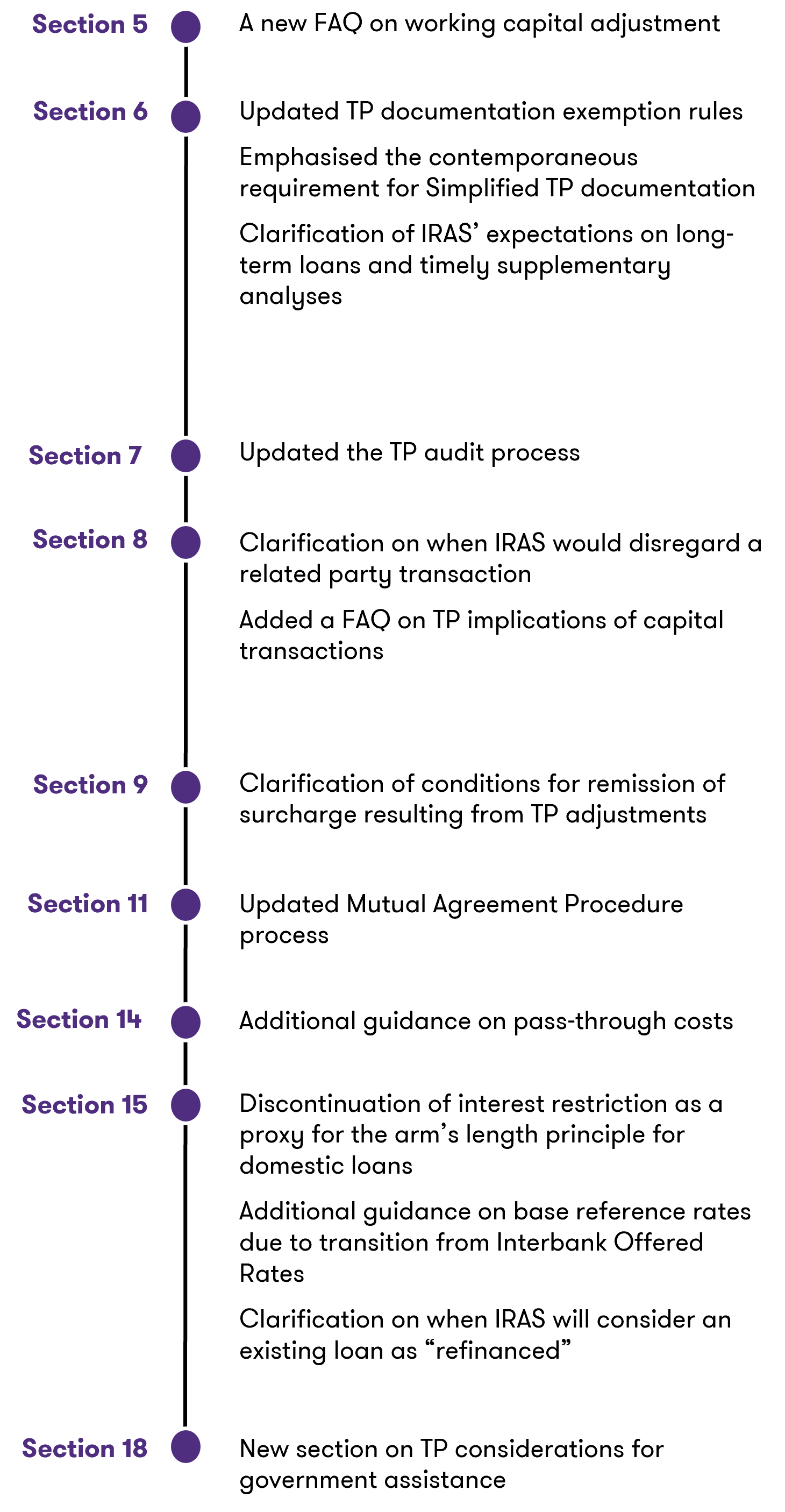

This edition introduces both minor and major updates across nine (9) sections of the Guidelines, reflecting an evolving and more sophisticated approach to TP analysis and compliance with the arm’s length principle.

Key Updates and Changes

Updates include clarifications on working capital adjustments, relaxation of the TP documentation exemption threshold, and an emphasis on the need for contemporaneous TP documentation. The guidelines now underscore the significance of timely supplementary analyses and provide updates on the TP audit process.

Furthermore, there is additional clarification on when related party transactions may be disregarded and a (logical) confirmation of the exemption from TP assessment for capital transactions. The conditions for the remission of surcharges resulting from TP adjustments, the processes engaged in the Mutual Agreement Procedure, and conditions of strict pass- through costs have also been elaborated upon.

Perhaps the most notable change is the discontinuation of interest restriction as a proxy for the arm’s length principle for domestic loans. This could have a further-reaching impact than first expected.

But the updates to theon intercompany financing transactions section also provide insights on base reference rates transitioning from Interbank Offered Rates, expectations for an annual review of long-term loans, and the criteria for determining whether a loan has been refinanced.

Further, TP considerations for government assistance, outlined by the IRAS on their website during the COVID-19 pandemic, have been included to enhance the comprehensiveness of the Guidelines.

Implications for Businesses

Amid these numerous updates, the overarching message remains clear: Comprehensive TP analysis and documentation are imperative for preventing and resolving tax disputes. The shift from an “inform-and-discuss” approach by the IRAS (I am about to shoot you) to an “assess-and-adjust” approach (shoot first, ask questions later) holds significant implications for taxpayers.

This shift places a more substantial burden of proof on taxpayers to substantiate their related party arrangements. The TP dispute and appeal process is now within a more legalistic framework, notwithstanding the fact that the transactions may qualify for TP documentation exemption.

Given these developments, it is crucial for businesses to ensure that their TP policies and documentation are meticulously reviewed and remain up to date. This proactive approach not only facilitates compliance but also fortifies the position of businesses in potential TP disputes.

As the IRAS adopts a more stringent stance, businesses’ proactive role in ensuring meticulous defence documentation is more important than ever.

In conclusion, the 7th edition of the Singapore TP Guidelines represents a “more crucial than you think” development in the TP regulatory environment. Businesses must acknowledge the heightened expectations and the critical importance of robust TP analysis and documentation in dispute prevention and resolution.

By proactively adapting to these changes and rigorously reviewing their existing TP policies, analyses and conclusions in alignment with the latest guidance provided or position taken by the IRAS, businesses can adeptly navigate and mitigate tax and TP exposures.