Introduction to the Carbon Border Adjustment Mechanism (CBAM)

With the clock ticking on climate change, the European Union (EU) stepped up in 2021 and unveiled the Carbon Border Adjustment Mechanism (CBAM) where fees are charged on carbon footprint of certain imports. This game-changer aims to curb emissions, level the playing field, and unlock opportunities for innovation and a greener future.

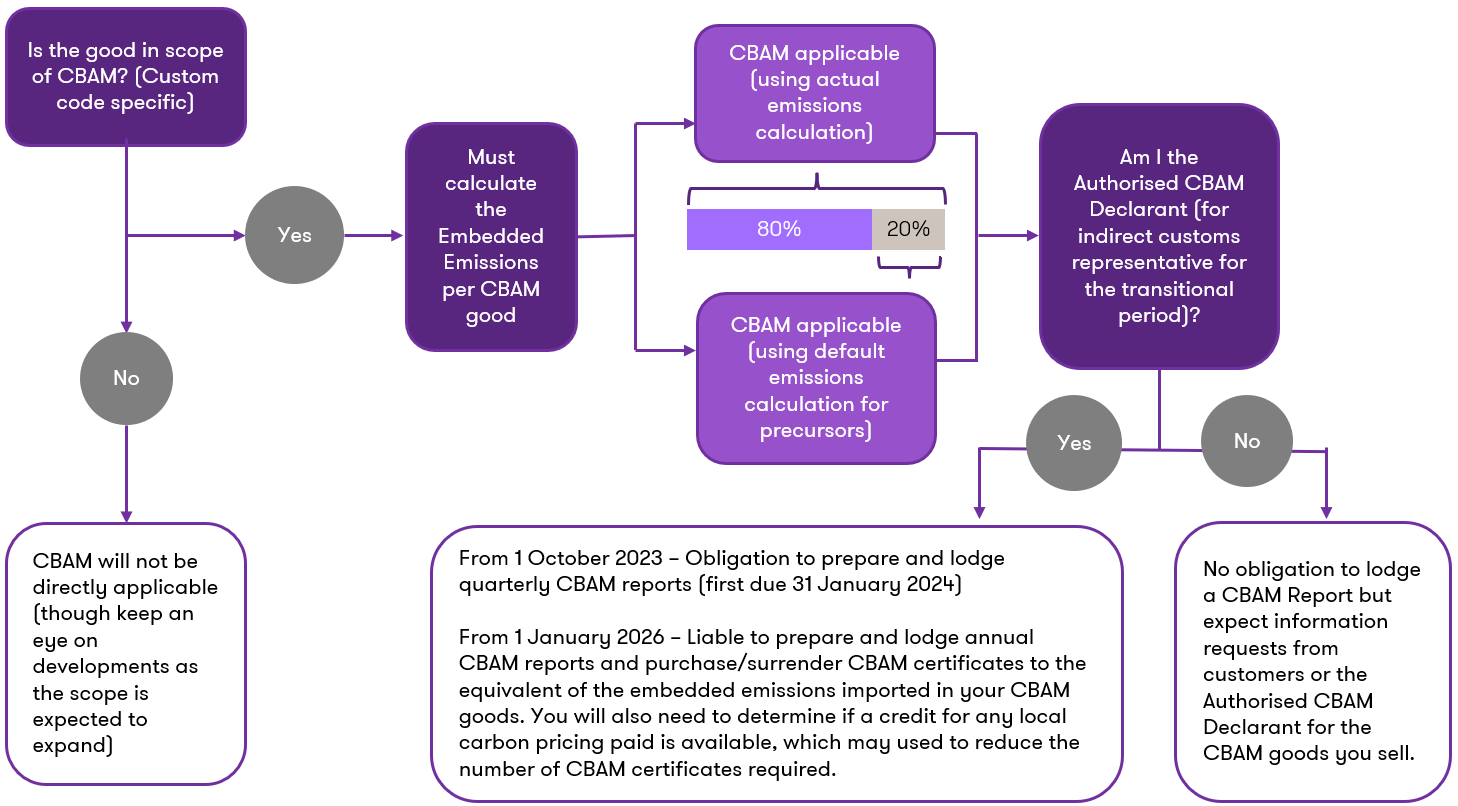

High level mechanism of CBAM

The CBAM is starting with a two-year transitional phase from October 2023 to December 2025. This gives businesses time to navigate a brand new and complex carbon accounting system, while the EU refines their own system. By January 2026, the CBAM will be fully operational and imported goods will have to pay a carbon fee on their emissions, just like domestic products under the EU Emissions Trading System (EU ETS). To encourage countries and businesses outside the EU to adopt cleaner practices, goods produced with lower emissions pay smaller fees. After 2026, ignoring the CBAM won’t be an option as hefty fines awaits those who don’t comply with the rules.

Industries and scope coverage

Leading the charge towards a greener future, CBAM starts by targeting the following six industries, known for their high carbon footprint and potential to relocate production.

Whilst targeting industries helps, it is not enough to reach net-zero goals without addressing the significant emissions from transportation, agriculture, and building heating.

| Share of global greenhouse gas emission | |

|---|---|

|

Iron & steel

|

7.2% |

|

Chemical and petrochemicals

|

3.6% (energy-related), 2.2% (direct) |

|

Nonferrous metals

|

0.7%

|

|

Cement

|

3.0%

|

Source: Emissions by sector, Our world in Data 2020

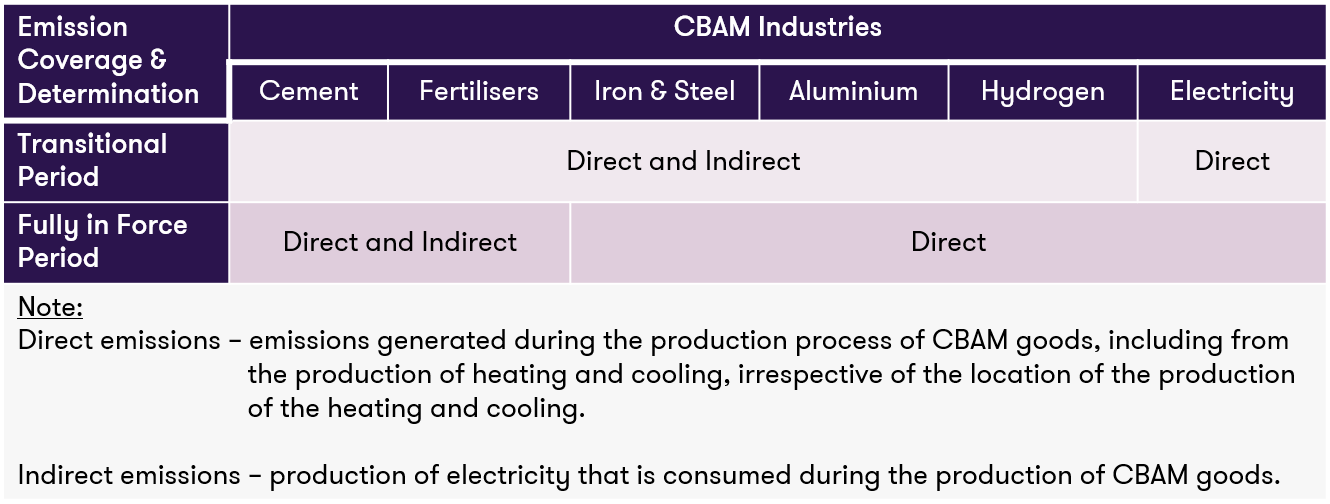

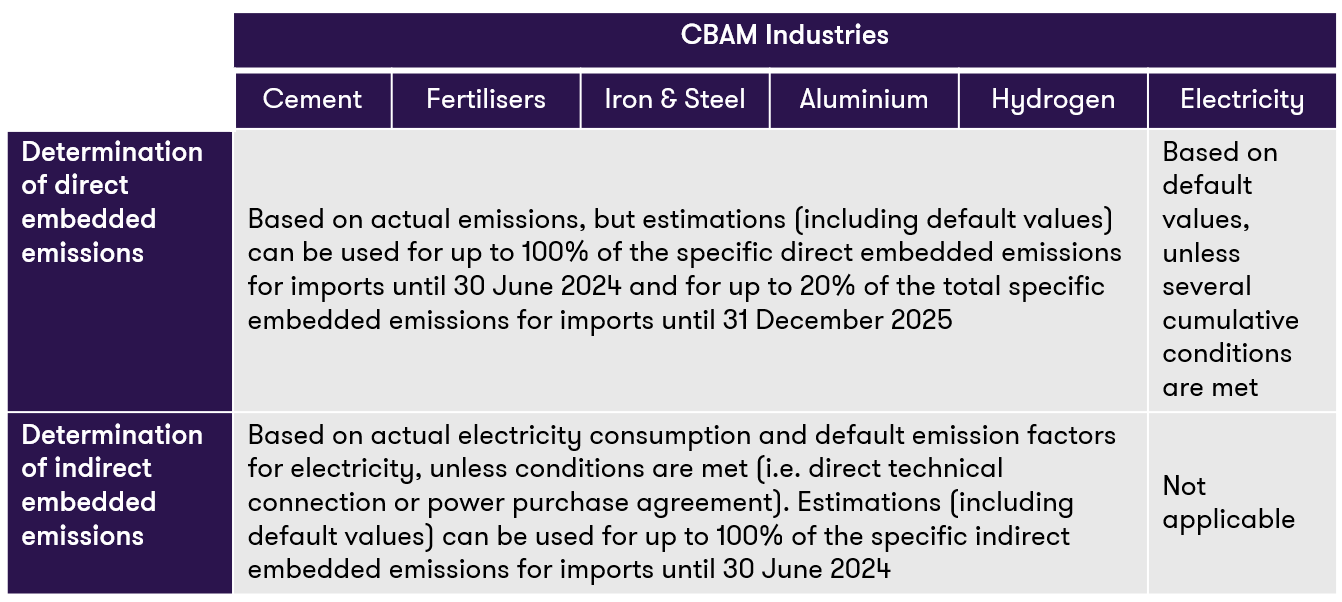

During the transition, the electricity industry only needs to track its own footprints, while other five industries with larger carbon footprints and tangled supply chains, need to report both direct and indirect emissions. To make things easier, the CBAM offers “default emission factors” to help companies estimate their indirect emissions without getting lost in the complexity. A good starting point to give everyone time to adjust before full reporting kicks in.

Cement and fertilisers play a big role globally, but also leave a bigger carbon footprint. That’s why, from 2026, they will continue to track their own emissions as well as that of the supply chain. To keep things simple and make compliance easier for businesses, the remaining four industries will only account for direct emissions. However, by focusing on direct emissions, we might miss hidden emissions upstream, potentially underestimating the true climate impact of imported goods.

Source: CBAM Q&A

Key steps in CBAM process

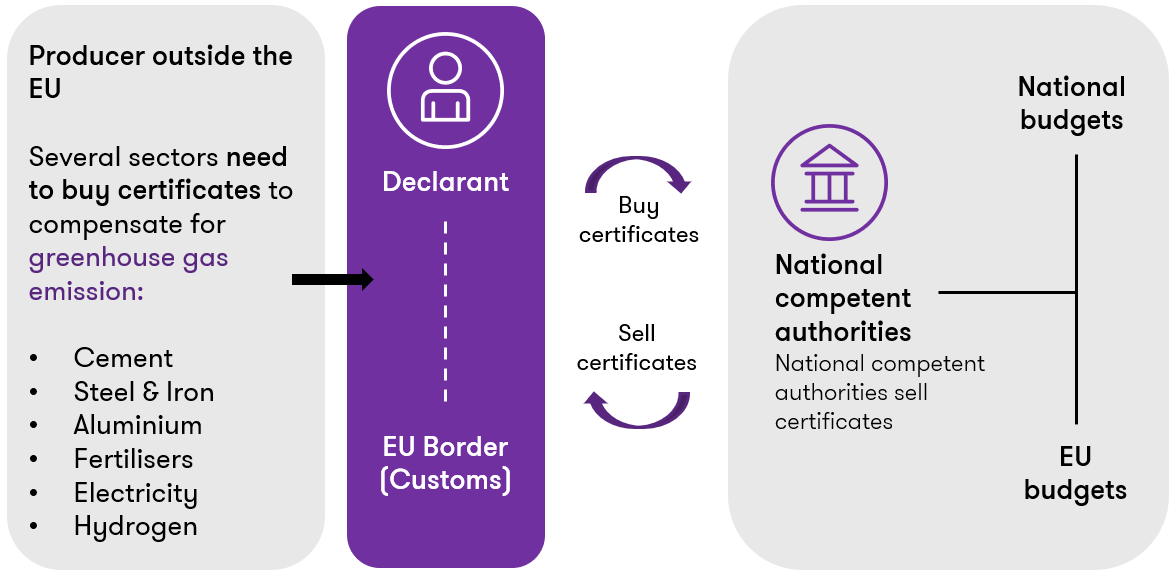

To get through CBAM smoothly, non-EU producers and EU importers need to work together, sharing information and calculating their emissions accurately. Else, goods risk getting stuck at the border and incur hefty carbon fines. Following illustrates the five steps CBAM processes:

Source: European Commission, ING Research

Step 1: Identification and calculation of embedded emissions

Before sending their goods to Europe, producers outside the EU collects data and calculates the embedded emissions of goods they are exporting (i.e. energy used to make the product, carbon footprint of the raw material, waste generated in the process). Some of the calculation methods to consider are:

- Detailed tracking - Life Cycle Assessment (LCA): Every step, from raw materials to waste disposal, gets analysed, giving the most accurate picture.

- Verified supplier declarations: Rely on verified data from suppliers and obtain their officially approved products' carbon footprint reports to ensure accuracy.

- EU estimates - Default values: The EU offers default values as a temporary solution until non-EU producers attain a more precise data.

- Specific industry methods: Some industries have their own established calculation methods recognised by the EU. These can be more tailored to specific production processes, offering a good balance between accuracy and effort.

- EU training: Get help from the EU to understand CBAM requirements and choose the best method for the needs.

Non-EU producers send emission data to the declarant/importer, who then verifies it against the table below.

Source: CBAM Q&A

Importers must make sure the emission data received is correct. They can do this by looking at how the data was collected (e.g. analysing the LCA method used), checking for official certifications, comparing the data to industry standards, and sometimes even auditing or visiting the facilities themselves.

Step 2: Registration and declarations

Declarant / Importer files quarterly reports via the CBAM website, providing specific details like embedded emissions, type of goods, origin country, and import quantity directly to the National Competent Authority (NCA).

| Reporting period | Submission due by |

|---|---|

|

2023: October - December

|

2024: January 31 |

|

2024: January - March

|

2024: April 30

|

|

2024: April - June

|

2024: July 31

|

|

2024: July - September

|

2024: October 31

|

|

2024: October - December

|

2025: January 31

|

|

2025: January - March

|

2025: April 30

|

|

2025: April - June

|

2025: July 31

|

|

2025: July - September

|

2025: October 31

|

|

2025: October - December

|

2025: January 31

|

Source: CBAM Q&A

Step 3: Verification and issuance of CBAM certificates*

NCA verifies the reported emissions. If verified, they grant importers CBAM certificates and channel the collected payments to the EU budget, directly supporting the EU's carbon trading scheme.

Step 4: Surrender of CBAM certificates*

- Declarant / Importer hands over their CBAM certificates to NCA, completing their responsibility to offset the carbon footprint of their imports.

- NCA permanently cancels the submitted CBAM certificates, ensuring they can't be used again and marking the completion of the importer's responsibility.

Step 5: Customs clearance and goods import

Only after verifying the presence of valid CBAM certificates, do EU authorities authorise their release into the European market.

*During this initial phase, importers are only responsible for reporting the embedded emissions of their imported goods. CBAM certificates are currently free and do not require any financial contribution. However, to ensure accuracy and effectiveness, penalties ranging from EUR 10 to EUR 50 per tonne will be applied for underreporting.

Come 2026, EU businesses will need to purchase CBAM certificates priced like EU ETS allowances. This ensures equivalent carbon costs for imported and domestically produced goods, fostering a level playing field. Only authorised declarants can purchase these certificates, which must be surrendered annually by 31 May.

Source: PWC

Between 2026 and 2034, the EU will phase out free carbon allowances for businesses under the EU ETS as they gradually switch to CBAM, where they pay their carbon emissions directly. This ensures everyone pays the same price for pollution, regardless of where it comes from.

| 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2023 | 2034 | |

|---|---|---|---|---|---|---|---|---|---|

|

CBAM (%)

|

2.5

|

5

|

10

|

22.5

|

48.5

|

61 |

73.5

|

86

|

100

|

|

Free allowance (%)

|

97.5

|

95

|

90

|

77.5

|

51.5

|

39

|

26.5

|

14

|

Source: European Parliament *Climate change: Deal on a more ambitious ETS*

While the CBAM's goal is admirable, the process involving calculations, declarations, verifications, and certificate management could impose a significant burden on importers in terms of cost and administrative workload. Simplifying and optimising these processes would offer a smoother implementation experience.

Impact of CBAM

The CBAM aim to curb global emissions is laudable, but critics argue that it could potentially favour EU businesses and hurt developing countries. With increased costs and complex CBAM rules, it makes it harder for developing countries to invest in clean technology and compete with EU companies already benefitting from ETS allowances.

The EU defended that CBAM follows World Trade Organisation (WTO) rules by targeting carbon leakage and not keeping the revenue, even though there is no official ruling yet. Some suggest quantifying CBAM's real impact, addressing concerns about developing nations, and even using revenue to help them adopt clean technology to strengthen EU's defence. It’s hard to say for sure if CBAM follows WTO rules, which is open to interpretation.

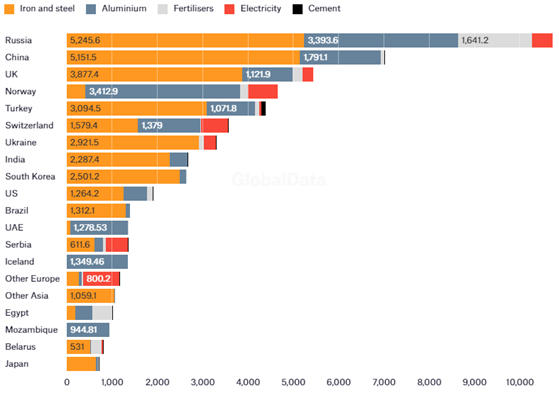

Top 20 countries most exposed to CBAM

Based on 2019 data, Russia stands to lose the most from CBAM with over USD10 billion in vulnerable industries. Both Russia and Turkey are developing their own ETS to mitigate the impact by 2026. Eleven other countries have similar mechanisms offering some relief, while six (Brazil, UAE, Serbia, Egypt, Mozambique, Belarus) are still exploring options. Ukraine’s focus remains on post-war reconstruction. Whilst most countries are actively engaging the EU, seeking exemptions or solutions to navigate CBAM, China is seeking alternative markets to reduce its dependency on EU market.

Source: Eurostat

With CBAM officially in its transitional phase, a crucial question remains, will EU adapt CBAM to respond to developing countries' concerns and potential trade diversion, or risk delaying its climate objectives? Essentially, open communication and ongoing dialogue with trading partners is key to a fair, inclusive, and effective global carbon pricing system.

Economic benefits and challenges

CBAM can be a double-edged sword for global trade. While its goal is a cleaner planet, the economic implications for importers and exporters are multifaceted. Let’s delve into the potential benefits and challenges for both sides:

| Exporter (Non-EU businesses) | Importer (EU businesses) | |

|---|---|---|

|

Economic benefits

|

|

|

|

Potential challenges

|

|

|

As CBAM continues to roll out, its impact on the global economy remains to be seen. Whether it’s embracing green technologies, seeking collaboration, or navigating new compliance requirements, one thing’s for sure, proactive adaptation is key. Businesses that prioritise sustainability are better positioned to thrive in the new trade landscape. It’s time to act!