#1 Mandatory requirements

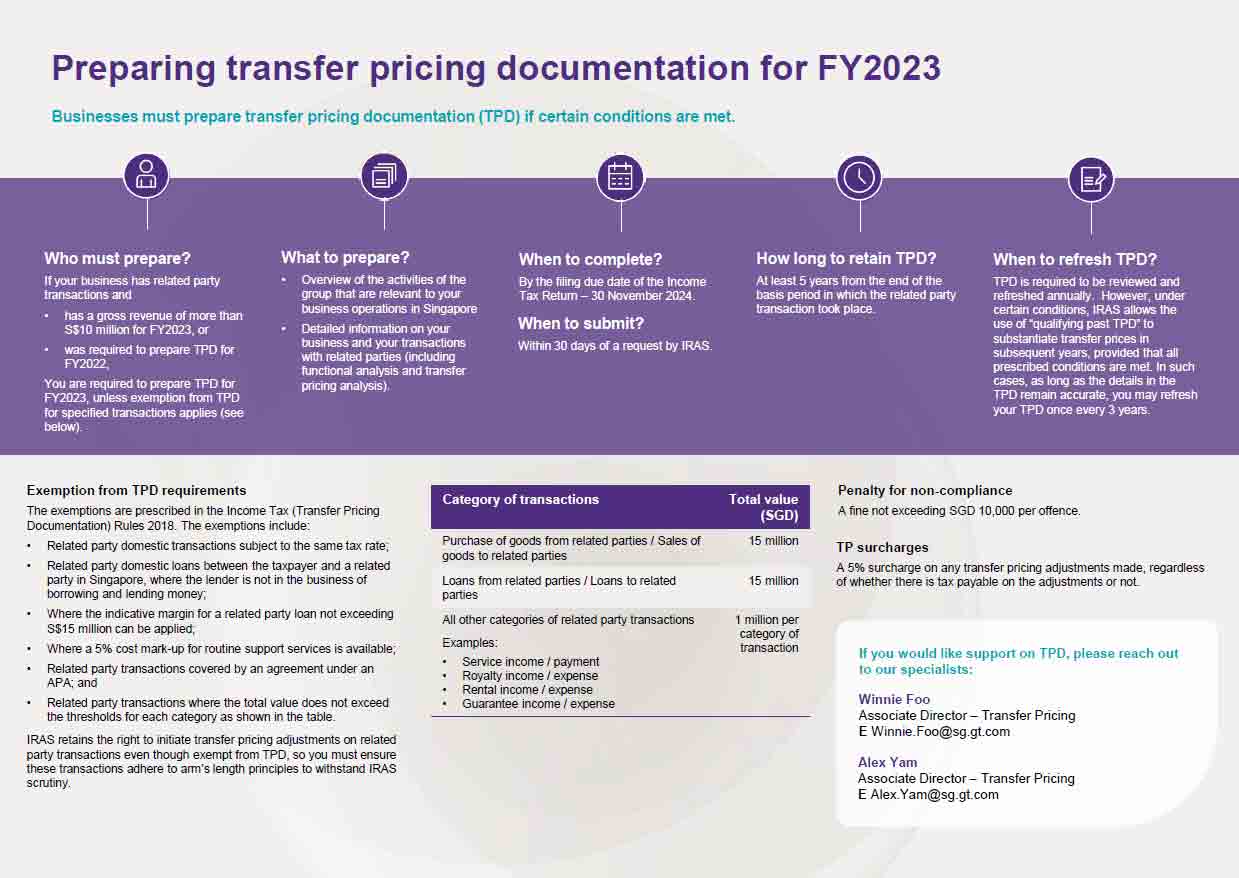

From the year of assessment (YA) 2019 onwards, unless exemption from TPD for specified transactions applies (see further on point 4), Singapore taxpayers must prepare TPD when either of the following two conditions are met:

- The gross revenue from their trade or business for the basis period concerned is more than SGD 10 million, or

- They were required to prepare TPD for the previous basis period.

#2 Purpose and importance of TPD

TPD is crucial for taxpayers to demonstrate that their related party transactions are conducted at arm’s length. Together with inter-company agreements, TPD serves as the primary defence during transfer pricing audits.

If the taxpayer is unable to show with their TPD that their transfer pricing is at arm’s length or they do not have TPD to substantiate their transfer prices, it can lead to several adverse consequences:

- If IRAS determines that the taxpayers have understated their profits through improper transfer pricing, they will make upward transfer pricing adjustments.

- In cases of double taxation resulting from transfer pricing audits by IRAS or foreign tax authorities, IRAS may not support the taxpayer in Mutual Agreement Procedure (MAP) discussions to resolve the double taxation.

- Applications for Advance Pricing Arrangement (APA) agreements may be rejected by IRAS.

- For transfer pricing adjustments made by IRAS for YA2019 or later, a surcharge of 5% will be imposed on the adjustments, regardless of whether there is tax payable on the adjustments (see further on point 10).

- Failure to comply with TPD requirements under Section 34F of the Income Tax Act 1947 (ITA) and the Income Tax (Transfer Pricing Documentation) Rules 2018 (TPD Rules), can result in fines (see further on point 9).

These consequences have the potential to disrupt business operations and damage a company’s reputation.

#3 Documentation requirements

Taxpayers are advised to adhere to the content requirements outlined in the TPD Rules when preparing their TPD, which include:

- Group-level information: An overview of the businesses of the group that is relevant to the taxpayers’ business operations in Singapore; and

- Entity-level information: Detailed information on the taxpayers’ business and their transactions with related parties, including functional analysis describing the functions performed, assets used and risks assumed by each party to each related party transaction and transfer pricing analysis to support the transfer prices applied.

#4 Exemption criteria

Taxpayers with gross revenue from a trade or business not exceeding SGD 10 million for the relevant basis period, or when not specifically requested by IRAS, are generally exempt from preparing TPD.

However, if taxpayers who are required to prepare TPD experience declining revenue such that their gross revenue is consistently below SGD 10 million, they will be exempted from preparing TPD if their gross revenue is not more than SGD 10 million for that basis period and the immediate two preceding basis periods.

For taxpayers who are required to prepare TPD under Section 34F of the ITA but are not eligible for the gross revenue exemption, a secondary check is applied to assess if TPD can be exempted for specific transactions under the TPD Rules. These specified transactions include:

a. Related party domestic transactions subject to the same tax rate;

b. Related party domestic loans between the taxpayer and a related party in Singapore, where the lender is not in the business of borrowing and lending money;

c. Where the indicative margin can be applied for a related party loan not exceeding SGD 15 million;

d. Where a 5% cost mark-up for routine support services is available;

e. Related party transactions covered by an agreement under an APA; or

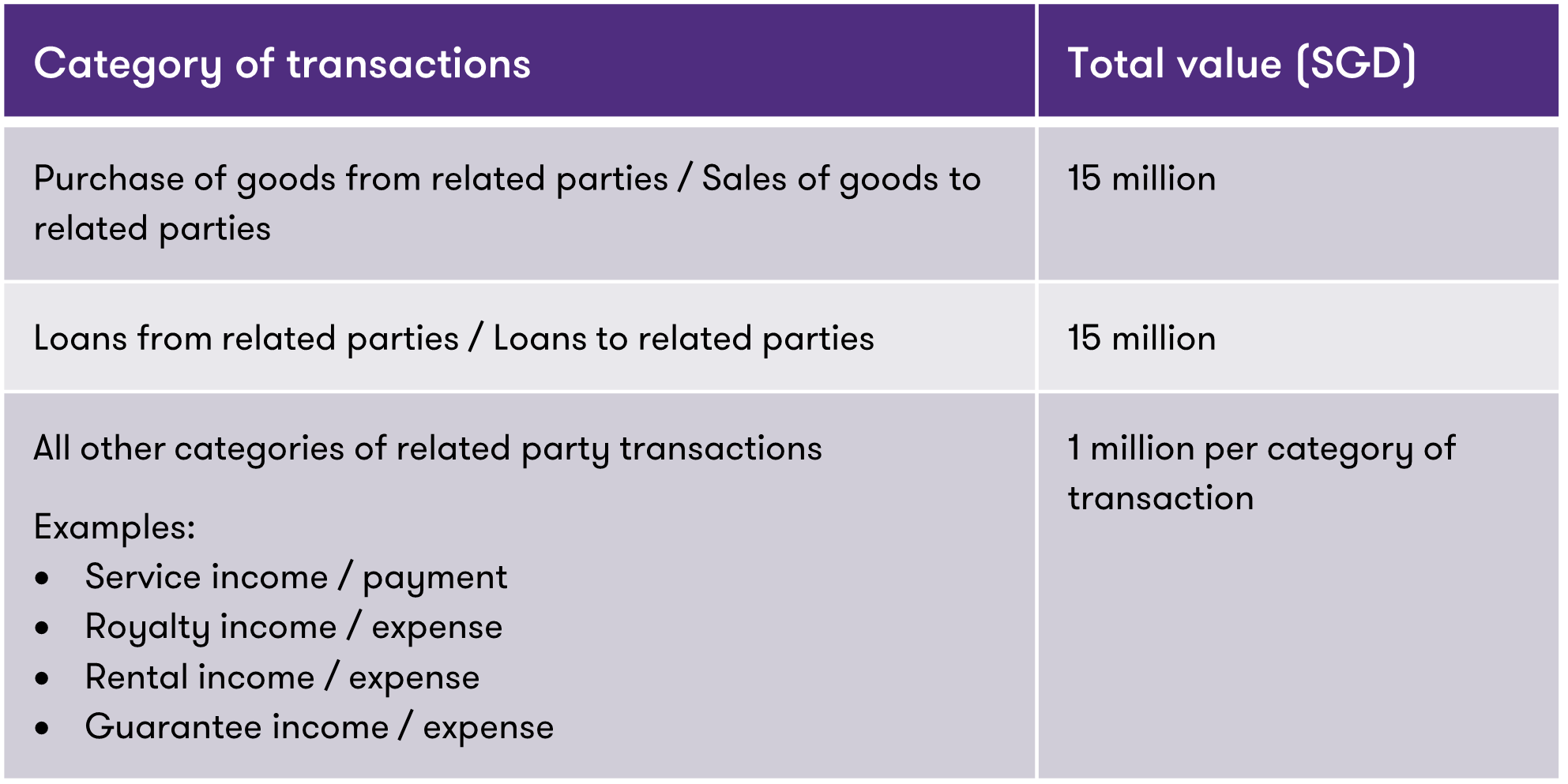

f. Where the total value or amount of all the related party transactions (excluding those mentioned in points (a) to (d) above) in the basis period concerned do not exceed the thresholds for each category as shown in the following table:

#5 Timing of TPD preparation

TPD must be completed by the filing due date of the Income Tax Return.

#6 Submission of TPD

Taxpayers are not required to submit their TPD when filing a tax return. However, they must submit their TPD within 30 days of a request from IRAS.

#7 TPD refreshment

Taxpayers are expected to review and refresh their TPD annually.

However, under certain conditions, IRAS allows the use of “qualifying past TPD” to substantiate transfer prices in subsequent years. To be regarded as “qualifying past TPD”, the TPD must meet the following criteria:

- The underlying transaction(s) in the subsequent financial period must be the same as those for which the TPD was prepared;

- The underlying transaction must involve the same related party in the subsequent financial period;

- The TPD must contain documentation of group level and entity level information, in accordance with the TPD Rules;

- The TPD must be prepared in English and include the date of preparation; and

- The following aspects between the taxpayer and related parties in the TPD must remain unchanged:

- Commercial or financial relations between related parties and taxpayers;

- The conditions made or imposed between related parties and taxpayers;

- Transfer Pricing methodology; and

- Arm’s length condition as defined in Section 34D of the ITA.

#8 Retention period

Taxpayers should retain TPD for at least 5 years from the end of the basis period in which the related party transaction took place.

#9 Penalties for non-compliance

Non-compliance with the TPD requirements may result in penalties not exceeding SGD 10,000 per offence. These offences include:

- Failure to prepare TPD by the time for the making of the tax return;

- Failure to prepare TPD with the details and in the form and content as prescribed by the TPD Rules;

- Failure to retain TPD for a period of at least 5 years;

- Failure to submit TPD within 30 days from a request by IRAS; and

- Providing TPD that is false or misleading.

#10 TP surcharges

In cases where IRAS initiates transfer pricing adjustments, a 5% surcharge is imposed on the adjustments, regardless of whether there is tax payable on the adjustments made.

IRAS retains the right to initiate transfer pricing adjustments on related party transactions exempt from TPD, so taxpayers must ensure these transactions adhere to arm’s length principles to withstand IRAS scrutiny.

Under certain circumstances, IRAS may grant a full or partial remission of the surcharge. These circumstances include co-operative and responsive behaviour of taxpayers, maintenance of contemporaneous TPD and good tax compliance records.

Conclusion

We encourage taxpayers to take a proactive approach to managing their transfer pricing risks by preparing contemporaneous TPD. During the preparation of such documentation, there is often an opportunity to identify further risk mitigation strategies. By proactively managing their transfer pricing risks and ensuring proper documentation, taxpayers can mitigate these risks and maintain good tax compliance.

Subscribe for timely technical updates and keep on the pulse with industry developments